Understanding Credit Card Refunds: How It Affects Your Financial Life

Anúncios

Understanding how these refunds work can help better manage your finances and avoid unpleasant surprises.

In this guide, we will explore in detail what credit card refunds are, how they work, common reasons for refund requests, the entire process involved, and much more.

Anúncios

Keep reading to discover everything you need to know about this important operation in the use of credit cards.

What is a Credit Card Refund?

A credit card refund is the process by which the amount of a transaction is credited back to your credit card.

Anúncios

This can occur for various reasons, such as returning a product, non-provision of a service, or billing errors.

The refund is essentially a reversal of the original transaction, where the spent amount returns to the available balance of the card.

Understanding this dynamic is crucial to ensure your finances remain under control.

How Does a Credit Card Refund Work?

When you request a refund, the process begins with contacting the merchant where the purchase was made.

The merchant, after accepting the return or recognizing the error, will initiate the refund process through the payment processor.

This process can take a few days until the amount appears again as credit in your account. It’s important to note that processing time may vary depending on the merchant and the card issuer.

Common Reasons for Credit Card Refunds

Credit card refunds can be requested for several reasons, and we will explain which ones they are:

Return of Purchased Items

If you bought an item and decided to return it, the merchant will process a refund once the item is received back in acceptable condition.

This is one of the most common reasons for refunds and is usually processed quickly, depending on the merchant’s return policy.

The deadline for returning purchased items generally ranges from 7 to 14 days, which can vary according to the merchant’s policy.

Service Not Provided

In cases where a contracted service was not provided, you are entitled to receive a refund.

This can include situations such as an unfulfilled hotel reservation or a canceled flight without rescheduling options.

In these cases, it is crucial to provide proof that the service was not rendered as contracted.

Billing Errors

Billing errors, such as duplicate or incorrect charges, are also common reasons to request a refund.

Upon noticing an error, it is important to act quickly and contact the merchant or the card issuer to correct the situation.

If you do not act promptly, your process is likely to be more complicated.

The Credit Card Refund Request Process

Requesting a credit card refund may seem complicated, but following the correct steps can ease the process.

Contact the Merchant

The first step to requesting a refund is to contact the merchant where the purchase was made.

Explain the reason for the refund request and provide any necessary documentation to support your claim.

This contact is ideal for maintaining good communication with the merchant and explaining your reasons for the return.

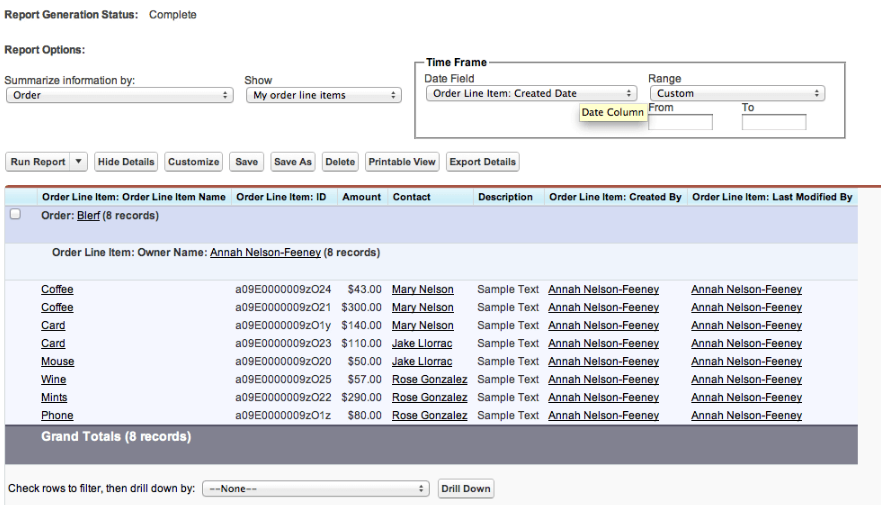

Provide Necessary Documentation

Depending on the reason for the refund, you may need to provide receipts, confirmation emails, or any documentation proving your purchase and the reason for the request.

Keeping detailed records of your transactions makes this process much easier, so remember not to throw away receipts.

Some necessary documents may be more important than others, but try not to lose any of them to ensure everything is in order.

Refund Receipt Timeline

Refund receipt timelines vary, but generally, you can expect the amount to be credited to your account within 7 to 14 business days after merchant approval and processing by the card issuer.

This period may be longer or shorter depending on the issuing bank and the payment method for the product.

In some cases, the refund may be issued immediately after the return request.

Challenges and Issues with Credit Card Refunds

Despite being a relatively simple process, credit card refunds can present occasional challenges.

Denied Refunds

Remember: not all refund requests will be approved; the credit issuer may consider your request invalid and not grant your refund.

If the merchant or the card issuer denies your request, you should investigate the reason for the denial and, if necessary, provide additional documentation or consider legal action.

You may “resubmit the proposal” to try for a new evaluation for approval.

Processing Delays

Processing delays for refunds can occur, especially in cases of international purchases or during high demand periods.

Maintaining constant communication with the merchant and the card issuer can help resolve these delays.

So, do not worry if your processing takes a while, but seek information from the issuer if the process takes more than 14 days.

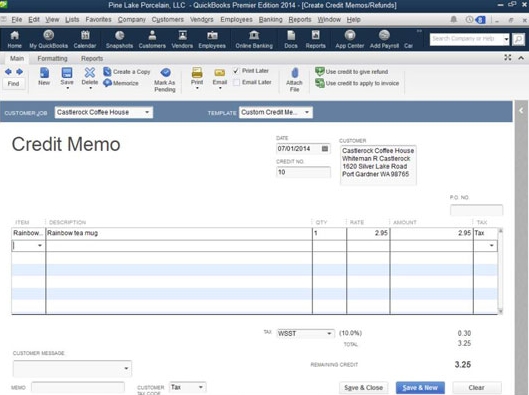

Partial Refunds

In some cases, you may receive a partial refund instead of the total amount paid for the product.

This may occur due to restocking fees, conditions of the returned product, or specific merchant policies.

These details cannot be discussed, as they must be notified before the refund request.

Tips to Ensure a Smooth Credit Card Refund Experience

To avoid problems with your refund requests, follow the tips we have separated below:

Keep Detailed Records

Documenting all transactions and keeping receipts, invoices, and emails related to your purchases makes the refund request process much easier.

The records should be very detailed, specifying dates, times, locations, amounts, and other information.

Remember to organize this in folders, bags, or other places so you can locate them immediately.

Understand Your Credit Card Policies

Each credit card issuer has different policies regarding refunds, so be attentive.

Knowing these policies can help avoid surprises and ensure you know exactly how to proceed in these cases.

Evaluate such policies carefully before any purchase to avoid possible companies.

Act Quickly

The faster you act upon noticing a problem or needing a refund, the more efficient the process will be.

Contacting the merchant immediately can prevent complications and delays, or even the loss of this benefit.

Some merchants may create rules, such as deadlines for granting a product refund, which complicates the process when delayed.

Legal Rights and Protections for Credit Card Refunds

Consumers have legal rights and specific protections when it comes to credit card refunds.

Federal Laws

In the United States, some federal laws, such as the Fair Credit Billing Act, protect consumers in billing disputes.

They act to ensure errors are corrected and that consumers are not held responsible for unauthorized charges.

This law greatly facilitates ensuring your rights, preventing possible merchants from causing you losses.

State-Specific Regulations

In addition to federal laws, some states have additional regulations that offer extra protections to consumers.

Familiarizing yourself with these regulations can provide an extra level of security in different states.

Seek to learn what these regulations are to become more aware of your purchases.

Credit Card Company Policies

Credit card companies also have their own consumer protection policies, which may include refunds for fraud or unauthorized charges.

Reviewing these policies can be very useful to understand your rights and protections, so always seek to learn more about them.

Special Cases in Credit Card Refunds

Some situations require special attention when it comes to credit card refunds.

International Purchases

Purchases made on international websites or stores may present additional challenges, such as differences in return policies and longer processing times.

Being aware of these factors can help manage expectations.

Disputes with Large Retailers

Large retailers may have more complex refund processes due to the volume of transactions. Following the retailer’s specific guidelines can facilitate the process.

Refunds for Digital Goods and Services

Digital goods and services, such as software downloads or subscriptions, may have different refund policies. It is important to understand these policies before making a purchase.

Understanding credit card refunds is essential for efficient financial management.

By following the guidelines and tips provided in this guide, you will be better prepared to deal with any issues related to refunds.

Remember to always keep detailed records, act quickly, and be aware of your rights to ensure your finances remain in order.