How to File Freshbooks Sales Tax?

Anúncios

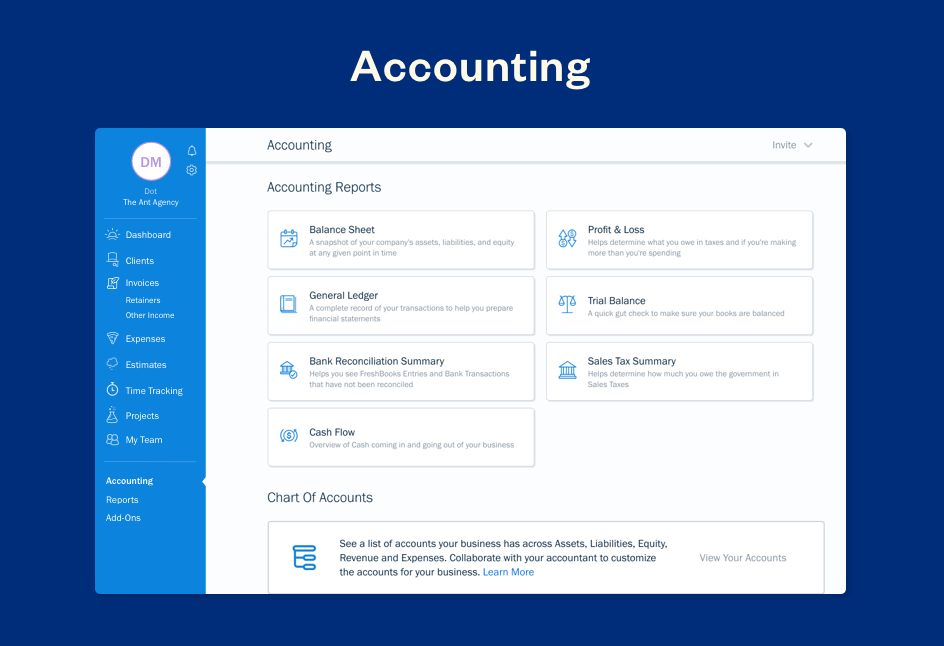

Sales tax can be a confusing and daunting task for small business owners, but it doesn’t have to be! FreshBooks makes it easy to file your sales tax with their simple and straightforward platform. In this blog post, we’ll walk you through the steps on how to file your sales tax with FreshBooks.

8. Freshbooks – Create / Setup Sales Tax

- In Freshbooks, go to the Taxes tab and click on Add Sales Tax

- Enter the name of the tax authority and the tax rate

- Choose whether the tax is applied to invoices, expenses, or both

- Click Save Changes

Sales Tax Accounting

Sales tax can be a complex and confusing topic for business owners, especially when it comes to accounting and record keeping. Here are some basics about sales tax accounting to help you keep everything straight.

When you make a sale, you need to charge the appropriate sales tax rate for the jurisdiction in which the sale took place.

This sales tax rate is generally a combination of state and local taxes. You then need to remit this money to the appropriate taxing authority.

To properly account for sales tax, you’ll need to keep track of all your sales receipts and invoices that include sales tax.

When you make a sale, you should note the amount of sales tax charged in your records. Then, when it comes time to file your taxes or do your quarterly estimated payments, you can deduct the total amount of sales tax collected from your gross income.

If you have any questions about how to handle sales tax accounting in your business, be sure to speak with an accountant or other financial advisor who can help ensure that you’re doing everything correctly.

Anúncios

Sales Tax Journal Entry

Sales tax is a consumption tax imposed by the government on the sale of goods and services. The amount of tax imposed depends on the jurisdiction in which the sale takes place. In most jurisdictions, sales tax is calculated as a percentage of the selling price of the good or service.

When a business makes a sale, they must collect sales tax from the customer and remit it to the government. This can be done through a variety of methods, depending on the jurisdiction in which the business operates. Businesses may also be required to file periodic reports detailing their sales and remittances.

When a business pays sales tax to the government, this is recorded as a liability on their financial statements. When businesses remit payment for their quarterly or annual sales taxes, they will record this payment as a reduction to their liability.

Sales Tax Payable Formula

Sales tax is a tax levied on the sale of goods and services. The tax is usually calculated as a percentage of the sale price. In most jurisdictions, the tax is collected by the seller at the time of sale.

The amount of sales tax payable can be calculated using this formula:

Sales Tax Payable = Sale Price x Sales Tax Rate

For example, if the sale price of an item is $100 and the sales tax rate is 10%, then the sales tax payable would be $10.

Anúncios

Sales Tax Payable Example

Sales tax payable is a current liability account that shows the amount of sales tax owed to the government by a business. This account is used to track money that the business owes for sales made to customers in jurisdictions where the business is required to collect and remit sales tax.

The balance in the sales tax payable account will increase when the business makes sales to customers in jurisdictions where it is required to collect and remit sales tax.

The balance in this account will decrease when the business pays its quarterly or annual sales tax bill to the government.

If a business does not pay its Sales Tax Payable, it will be subject to penalties from the government. This can include interest and late fees, as well as possible audits.

Therefore, it’s important for businesses to keep on top of their Sales Tax Payable and make sure they are paying it on time.

Sales Tax Payable is What Type of Account

Sales tax payable is an account that represents the amount of sales tax that a company owes to the government. This account is used to keep track of the taxes that are owed so that they can be paid on time.

Credit: windowsreport.com

How Do You Record Sales Tax?

Sales tax is a tax levied on the sale of goods and services. The tax is typically calculated as a percentage of the sale price. In most jurisdictions, the sales tax rate is set by the government and administered by the revenue department or other agency responsible for collecting taxes.

When you make a sale, you must collect the appropriate amount of sales tax from your customer and remit it to the government. Depending on the jurisdiction, you may be required to file periodic reports and make payments even if you do not collect any sales tax from your customers.

To ensure that you are correctly calculating and remitting sales tax, it is important to keep accurate records of your sales.

You should record each sale in your accounting records, including the date, amount, product or service sold, and the name and address of the customer. If you use accounting software, many programs will allow you to track sales tax collected and paid.

If you have questions about how to record sales tax or which rates apply to your business, contact your state revenue department or seek out advice from a qualified accountant or attorney.

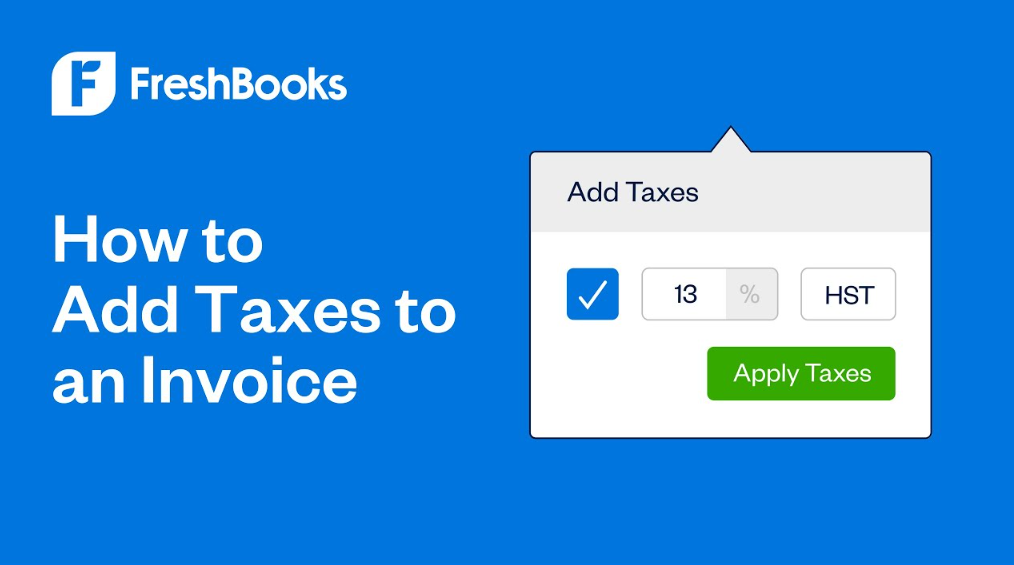

How Do You Add Sales Tax to Invoice?

Sales tax is a levy placed on the sale of goods and services. The amount of sales tax charged depends on the type of transaction and the location where it takes place. In many jurisdictions, businesses are required to collect sales tax from their customers and remit it to the government.

To add sales tax to an invoice, businesses must first determine the applicable sales tax rate. This can be done by looking up the rates for the specific jurisdiction in which the sale took place. Once the applicable sales tax rate has been determined, businesses must calculate the amount of sales tax owed based on the total price of the invoice.

Finally, businesses must add the calculated amount of sales tax to the total price of the invoice before sending it to their customer.

How Do I Report Sales Tax in Tennessee?

When it comes time to file your taxes in Tennessee, you will need to report any sales tax that you have collected from customers during the year. This can be done by filing a Sales Tax Return with the state.

To help make the process of filing your return easier, it is a good idea to keep track of your sales tax collections on a monthly basis.

You can do this by using a sales tax tracking software or simply keeping a spreadsheet of your sales. Either way, having accurate records will make it much simpler to complete your return.

Once you have all of the necessary information gathered, you will need to fill out the Sales Tax Return form.

This form can be found on the Tennessee Department of Revenue website. Be sure to enter all relevant information accurately and completely, as any errors could result in delays or additional fees.

After you have completed and filed your return, you will need to remit any owed sales tax funds to the state.

This can be done via check or money order, or through an electronic payment system such as ACH debit or credit card payment. Once the payment has been processed, you will receive a confirmation receipt for your records.

What Account Type is Sales Tax?

Sales tax is an indirect tax imposed on the sale of goods and services. The tax is levied by the government on the selling price of the product or service. The seller collects the tax from the buyer and remits it to the government.

In most jurisdictions, sales tax is imposed on all sales of tangible personal property and certain services. Sales of real property are generally not subject to sales tax.

Some jurisdictions exempt certain types of transactions from sales tax, such as food for human consumption, medical devices, and pharmaceuticals.

Conclusion

Assuming you would like a summary of the blog post titled “How to File Freshbooks Sales Tax?”:

If you’re a small business owner, chances are you’re using FreshBooks to manage your finances. And if you’re selling products or services online, you may be wondering how to file your sales tax.

Fortunately, it’s relatively easy to do. In this blog post, we’ll walk you through the steps of filing your FreshBooks sales tax. First, log into your account and click on the “Settings” tab.

Then, click on the “Billing” sub-tab and scroll down to the “Sales Tax” section.

Click on the “+ Add Rate” button and enter the appropriate information for your state or province. Once you’ve added all of the necessary rates, be sure to click on the “Save Changes” button at the bottom of the page.

Now that you’ve set up your sales tax rates, it’s time to start collecting taxes from your customers. To do this, simply create an invoice as usual and select the appropriate tax rate from the drop-down menu. The tax amount will be calculated automatically and added to the total amount due.

That’s all there is to it! By following these simple steps, you can easily file your FreshBooks sales tax without any hassle.