How to Add Income in Ynab?

You’ve just started YNAB and you’re excited to get started on your budget. You’ve added all of your income sources and you’re ready to start categorizing your spending. But wait!

There’s one more thing you need to do before you can start using YNAB to its full potential – adding your income!

Income is an important part of the budgeting process, and it’s something that many people overlook. Without adding your income, you won’t be able to accurately track your spending or see where your money is going each month.

Luckily, adding income in YNAB is a quick and easy process.

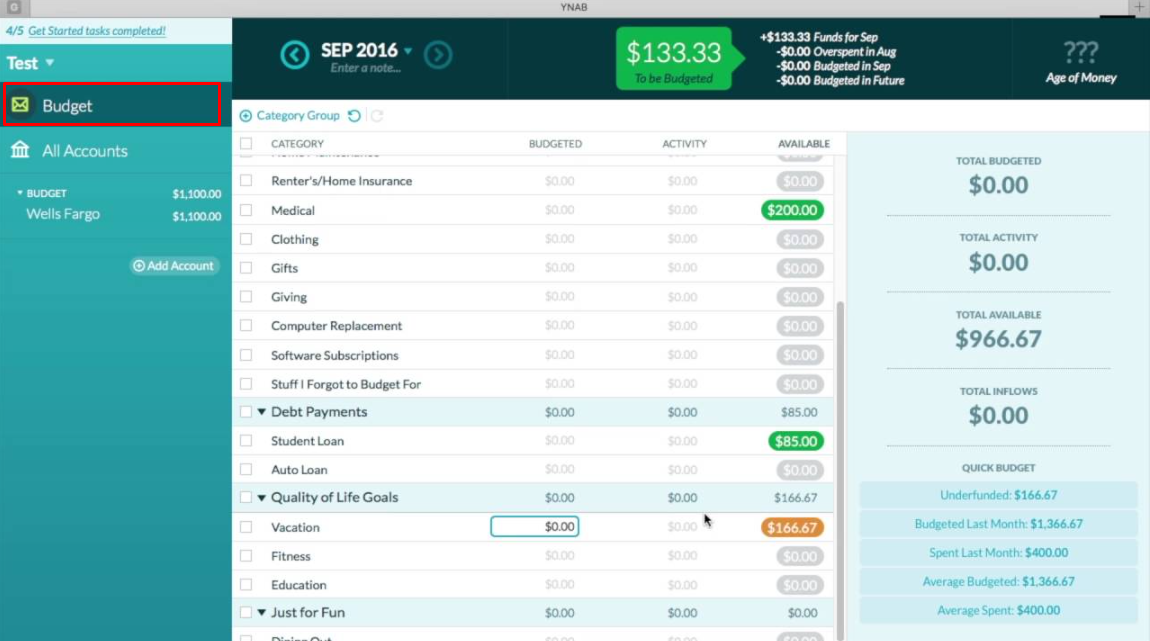

- Log in to Ynab and select the budget you want to add income to

- Click on the “Add Income” button located on the left hand side of the screen

- Enter the amount of income you want to add, as well as a description of where the income is coming from

- Select which account you want the income to be deposited into and click “Save

Credit: www.makingyourmoneymatter.com

How Do I Add Income in Ynab?

Assuming you would like a blog post on how to add income in YNAB:

“How do I add income in YNAB?”

Adding income in YNAB is pretty simple and straightforward.

The first thing you’ll want to do is create a new account for your income. To do this, click on the “Accounts” tab and then select “Add Account.” Give your account a name and then select “Income” as the account type.

Once you’ve done that, you can start adding transactions.

To add a transaction, click on the “Transactions” tab and then select “Add Transaction.” From there, you’ll be able to fill out all of the relevant information for your transaction, including the date, payee, amount, etc.

Once you’re finished, click “Save.” And that’s it! You’ve now successfully added an income transaction in YNAB.

Anúncios

How Do You Use Variable Income in Ynab?

If you’re like most people, your income varies from month to month. Maybe you have a full-time job, but you also do some freelance work on the side. Or maybe your hours at work fluctuate from week to week.

Whatever the case may be, YNAB can help you budget your variable income so that you always have enough money to cover your expenses.

Here’s how it works: when you get paid, enter the amount into YNAB as “Income for Future Months.” Then, when you need to spend that money in a future month, simply transfer it over to that month’s budget.

This way, you can make sure that your variable income is always being used in the most efficient way possible.

Of course, this system only works if you’re diligent about entering all of your income and expenditures into YNAB on a regular basis. But if you are, it can be a helpful tool for managing your finances and making ends meet each month.

Is Ynab Overpriced?

No, YNAB is not overpriced. In fact, it is one of the most affordable budgeting software options available. For just $5/month (or $50/year), you get access to all of YNAB’s features, including:

1. Goal setting and tracking

2. Debt reduction tools

3. Envelope budgeting system

4. Comprehensive financial reports

5. Personalized support from YNAB staff

There are other budgeting software options out there that charge more than twice as much as YNAB for similar features.

So when it comes to value, YNAB is definitely a good deal.

Anúncios

Is Ynab Confusing?

If you’ve never used YNAB (You Need A Budget), then the answer is probably “yes.” It can be confusing to try and wrap your head around a new system, especially one that’s designed to help you manage your money.

But once you get the hang of it, YNAB can be an extremely helpful tool for getting your finances in order.

In fact, many people who use it find that it’s life-changing.

So if you’re feeling confused about YNAB, don’t worry – we’re here to help. In this post, we’ll give you a quick overview of how YNAB works and explain some of its key features.

By the end, hopefully you’ll have a better understanding of what this powerful budgeting tool can do for you.

Creating Your Budget in YNAB

Does Ynab Automatically Import Transactions

If you’re like most people, managing your finances is not something that comes naturally. It’s a skill that must be learned and takes time and effort to master. One of the most important aspects of financial management is tracking your spending and income.

This ensures that you know where your money is going and what you have to work with each month.

There are a number of ways to track your spending and income, but one of the most popular methods is using budgeting software. Budgeting software allows you to input your income and expenses so that you can see exactly where your money is going.

You can also set up budgets and track your progress over time.

One of the most popular budgeting software programs is YNAB (You Need A Budget). YNAB has gained a loyal following among users because it’s easy to use and extremely effective at helping people stay on top of their finances.

One of the features that makes YNAB so popular is its ability to automatically import transactions from your bank account or credit card statements.

This means that you don’t have to manually enter every single transaction into the software – which can save a lot of time! It also ensures that all of your transactions are accounted for, which is crucial for accurate financial tracking.

So how does automatic transaction import work in YNAB? Let’s take a look…

How to Add Transaction to Ynab

If you’re like me, you probably have a love/hate relationship with money. I love earning it and hate spending it. But one thing I’ve always been good at is budgeting and saving.

So when I heard about YNAB (You Need A Budget), I was intrigued.

YNAB is a budgeting tool that helps you stay on top of your finances by tracking your income, expenses, and giving you a clear picture of where your money is going. One of the best features of YNAB is the ability to add transactions manually.

This means that you can keep track of every penny that you earn and spend, which can be helpful if you’re trying to stick to a budget or save for a specific goal.

Here’s how to add transactions in YNAB:

1. Log into your account and click on the “Accounts” tab at the top of the page.

2. Click on the account where you want to add the transaction (e.g., checking, savings, credit card).

3. Under the “Transactions” section, click on the “Add Transaction” button.

4. Enter the date, payee, category, amount, and any other relevant information for the transaction.

Be sure to check off whether or not the transaction has been cleared (e.g., if it’s a pending transaction).

Adding Income

There are many ways to add income to your household. You may be able to get a second job, or start a side business. You can also look for ways to make your money work harder for you, such as investing in real estate or stocks.

Whatever route you choose, be sure to do your research and understand the risks involved before taking any action.

Ynab Tutorial

If you’re looking for a more in-depth YNAB tutorial, this post is for you! We’ll cover everything from setting up your budget to using the app’s features to get the most out of it. By the end, you’ll be an expert at using YNAB to manage your finances!

First, let’s talk about setting up your budget. When you first open YNAB, you’ll be prompted to create a new budget. You can name your budget anything you want and add as many or as few categories as you’d like.

Once you’ve created your budget, it’s time to start adding transactions.

To add a transaction, simply click on the “Add Transaction” button and enter the relevant information. For example, if you paid for groceries with cash, you would enter the amount under the “Outflow” column and select “Cash” as the account.

Once you’ve added all of your transactions for the month, it’s time to start working on next month’s budget!

YNAB makes it easy to see where your money went last month and adjust your spending accordingly. Simply click on any category in yourbudget andyou’ll see a breakdown of where every dollar was spent.

This is an incredibly valuable tool that can help you make changes to ensure that your money is going where you want it to each month.

Finally, let’s talk about some of YNAB’s other features that can help you stay on top of your finances. The app offers goal setting so that you can save up for big purchases, track debt payoff progress, and much more.

There are also reports that show helpful information like how much money you have left to spend in each category or how close you are to reaching your monthly goals.

Overall, YNAB is an incredibly powerful tool that can help anyone get their finances under control.

Conclusion

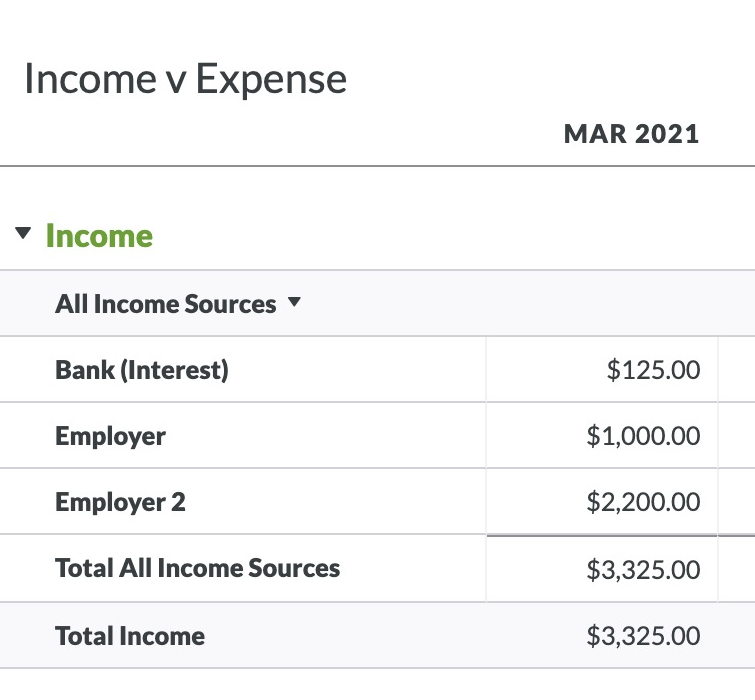

In YNAB, there are four ways to add income to your account: manual entry, importing from your bank, connecting your accounts, and mobile entry.

Manual entry is the simplest way to add income, and it’s what we recommend for most people. To manually enter income, just go to the Accounts page and click on the “Add Transaction” button.

From there, you’ll be able to select the account you want to add the income to, as well as the date, payee, category, and amount.

Importing from your bank is a good option if you don’t want to manually enter all of your transactions. To import from your bank, just go to the Accounts page and click on the “Import Transactions” button.

From there, you’ll be able to select your bank and follow the instructions on how to import your transactions.

Connecting your accounts is a great way to automatically import your income into YNAB. To connect your accounts, just go to the Accounts page and click on the “Connected Accounts” button.

From there, you’ll be able to select which accounts you want to connect and follow the instructions on how to do so.

Mobile entry is a handy option if you’re always on the go and don’t have access to a computer. To use mobile entry, just go to the Accounts page in YNAB and click on the “Mobile Entry” button.

From there, you can either enter your income manually or import it from your bank using our mobile app.