Does Ynab Work in Canada?

I recently had a reader ask me if YNAB (You Need A Budget) works in Canada. I was surprised by the question because I assumed that since YNAB is an online program, it would work anywhere. But I did some research and found out that there are a few reasons why YNAB may not be the best budgeting solution for Canadians.

Ynab is a great tool for budgeting, and it definitely works in Canada! The only issue you may have is with some of the terminology used, since Ynab is a US-based company. However, once you get past that, it’s a fantastic tool that can help you stay on top of your finances.

Credit: www.youneedabudget.com

Anúncios

Is Ynab an International?

YNAB is not an international company. They are a US based company that offers their software in multiple languages.

Is Mint Or Ynab Better?

When it comes to budgeting apps, there are a lot of options out there. Two of the most popular are Mint and YNAB (You Need a Budget). Both apps have their pros and cons, so which one is the best for you?

Mint is a free app that connects to your bank account and automatically tracks your spending. It categorizes your transactions and shows you where you’re spending the most money. Mint also provides customized tips on how to save money based on your spending habits.

YNAB is a paid app that costs $5 per month (or $50 per year). Unlike Mint, YNAB does not connect to your bank account automatically. Instead, you manually enter your transactions into the app.

This may sound like more work, but it actually gives you more control over your budget since you’re manually entering everything yourself. YNAB also uses a ” envelope” system, which means you give each dollar a job before you spend it. This helps prevent overspending in any one category.

So, which budgeting app is better? It really depends on what you’re looking for. If you want an easier (but less accurate) way to track your spending, then Mint is probably a good choice for you.

However, if accuracy and control are more important to you, then YNAB is worth the extra effort required to manual input all of your transactions.

Anúncios

Can You Trust Ynab?

In short: yes, you can trust YNAB. Here’s why:

YNAB is a budgeting app that helps you manage your money.

It connects to your bank account and tracks your spending. You can set up budgets and see how much money you have left to spend in each category.

YNAB is a tool that can help you get control of your finances.

It’s not perfect, but it can be a helpful addition to your financial arsenal.

Is Everydollar Better Than Ynab?

There’s no easy answer when it comes to which budgeting software is better – EveryDollar or YNAB? Both have their pros and cons, and ultimately it depends on your specific needs as to which one would work better for you.

EveryDollar is a budgeting software created by Dave Ramsey, a well-known financial guru.

One of the main selling points of EveryDollar is that it’s very simple and straightforward to use. You can easily create a budget with EveryDollar and there’s no learning curve involved.

However, one downside of using EveryDollar is that it doesn’t offer much in terms of features.

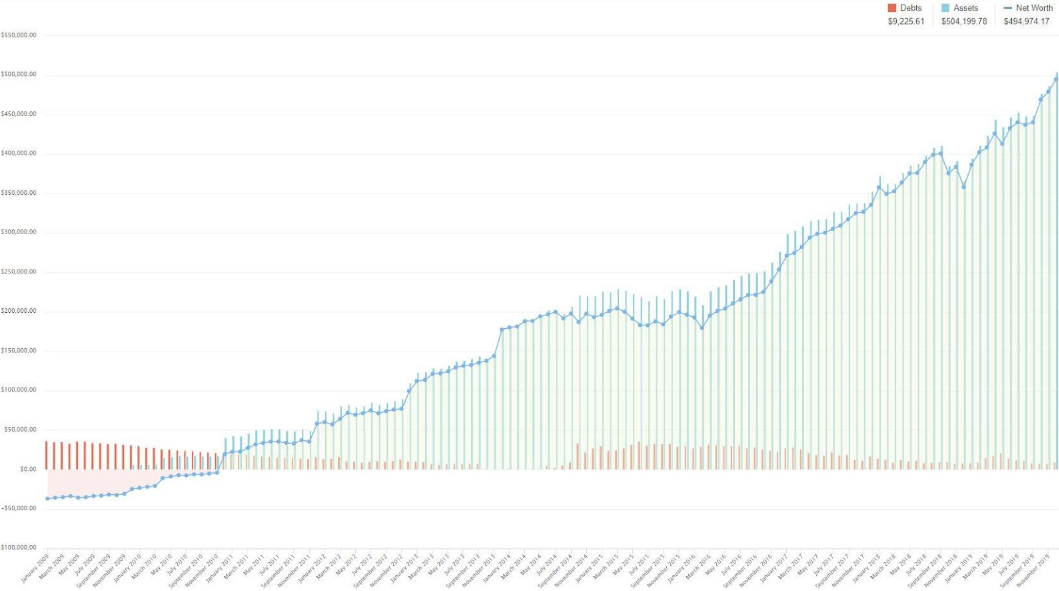

If you’re looking for something more robust, with more bells and whistles, then YNAB might be a better option. YNAB (You Need A Budget) is a bit more complex than EveryDollar but it offers more features, such as tracking your net worth, setting goals, and connecting to your bank account to automatically import transactions.

So which budgeting software should you use?

It really depends on what you need from your budgeting tool. If you want something quick and easy to use with no learning curve, go with EveryDollar. However, if you’re looking for something more feature-rich, then YNAB might be the better choice.

Why YNAB doesn’t work

Ynab Canada Reddit

There are a lot of people out there who are looking for ways to save money. One way that you can do this is by using YNAB Canada Reddit. This is a website where you can find a lot of different tips and tricks on how to save money.

You can also find coupons and deals that you can use to save even more money.

If you are someone who is trying to get their finances in order, then this is the place for you. There are a lot of people on this website who have been able to save a ton of money by using the tips and tricks that they have learned.

If you want to learn how to save money, then this is definitely the place for you.

Ynab Cost

Ynab, or You Need a Budget, is a budgeting app that aims to help you get control of your finances. The app starts by having you enter your income and expenses, then assigns every dollar a job. This can be helpful in seeing where your money is going each month and can help you find ways to cut back on spending.

The app costs $11.99 per month, but there is also a free trial available. Ynab does offer a discount for students and military personnel.

Ynab Vs Mint

It can be difficult to decide which budgeting software to use. Both YNAB and Mint are popular choices, but which one is right for you?

YNAB is focused on helping you proactively plan your spending.

Every dollar you earn is assigned a job, whether that’s saving for a goal or paying down debt. This system forces you to think about your spending in advance, which can help you make more informed decisions.

Mint, on the other hand, is more reactive.

It tracks your spending and provides insights into where your money goes. This can be helpful in identifying problem areas so you can make adjustments accordingly.

Both YNAB and Mint have their pros and cons.

Ultimately, the best budgeting software for you is the one that fits your needs and lifestyle the best.

Best Budget App Canada

If you’re looking for a budget app that works well in Canada, there are a few different options to choose from. First, let’s look at some of the most popular budget apps out there.

YNAB (You Need A Budget) is one of the most popular budgeting apps and it’s available in both a free and paid version.

The free version gives you access to all the features of the app, but limits you to tracking your spending for 30 days. The paid version costs $5/month or $50/year and gives you unlimited access to all the features of the app.

Mint is another popular budgeting app that’s available for free.

It gives you an overview of your spending, shows you where you can save money, and lets you set up budgets for specific categories. You can also connect Mint to your bank account so it can automatically track your spending.

There are also a few less well-known budget apps that are worth checking out, such as EveryDollar and Goodbudget.

These apps have similar features to YNAB and Mint but may be better suited for specific needs (such as tracking cash flow or envelope budgeting).

So which budget app is best for Canadians? Ultimately, it depends on what features you’re looking for and how much money you’re willing to spend (if any).

If you need help getting started with budgeting, YNAB or Mint would be good choices since they’re both easy to use and have a lot of helpful features. If you want more control over your finances or are looking for specific features like envelope budgeting, EveryDollar or Goodbudget may be better options.

Conclusion

If you’re looking for a budgeting tool that works in Canada, Ynab may be a good option for you. This blog post outlines some of the key features of Ynab and how they can benefit Canadian users. While there are some drawbacks to using Ynab in Canada (such as the lack of support for Canadian currency), overall it is a solid budgeting tool that can help you stay on top of your finances.