Does Square Integrate With Quickbooks?

Integrating QuickBooks with Square can save you time and help you better manage your finances. QuickBooks is a popular accounting software that allows you to track income and expenses, while Square is a point-of-sale system that lets you accept credit and debit card payments. When you connect the two, you can automatically import your sales data from Square into QuickBooks.

This can help streamline your bookkeeping and make it easier to track your business finances.

If you’re a small business owner, you’ve probably heard of QuickBooks. QuickBooks is a popular accounting software that helps businesses keep track of their finances. And if you’re looking for a way to accept credit card payments, you might be wondering if Square integrates with QuickBooks.

The short answer is yes, Square does integrate with QuickBooks. You can connect your Square account to QuickBooks and start tracking your sales and expenses in one place. That said, there are a few things to keep in mind before you get started.

For starters, it’s important to note that there are two different types of integration between Square and QuickBooks: online and offline. Online integration allows you to connect your accounts and share data in real-time. Offline integration requires you to export your data from Square and import it into QuickBooks manually.

Which type of integration you use will likely come down to personal preference. If you prefer the convenience of having everything in one place, online integration might be the way to go. But if you want more control over when and how your data is shared, offline integration could be a better option.

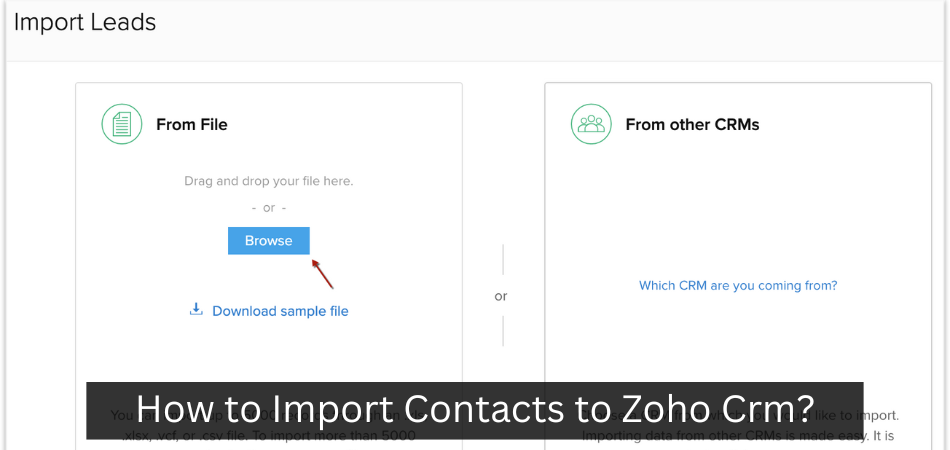

Once you’ve decided which type of integration you want to use, setting everything up is pretty straightforward. If you’re using online integration, all you need to do is sign in to your account on both Square and QuickBooks and follow the prompts to connect the two services. For offline integration, you’ll need to export your data from Square as a CSV file and then import it into Quickbooks following these instructions .

Overall, connecting Square with QuickBooks can be a helpful way to manage your business finances more efficiently. Just be sure to take some time beforehandto decide which type of integration makes the most sense for your needs!

How to connect your Square account with QuickBooks Online

Can Square And Quickbooks Work Together?

As a business owner, you’re always looking for ways to streamline your operations and save time and money. If you’re using QuickBooks for your accounting needs, you may be wondering if there’s a way to integrate it with Square, the popular point-of-sale system.

The good news is that there is a way to connect QuickBooks with Square.

By doing so, you can automatically sync your sales data from Square into QuickBooks, making it easy to keep track of your finances in one place. Here’s how it works:

1. Make sure you have the latest version of QuickBooks and the latest version of the Square app installed on your device.

2. In QuickBooks, go to the Lists menu and select Integrations.

3. Select Connect next toSquare Integration (Beta).

4. A pop-up window will appear asking you to sign in or create an account with Intuit (the company that makes QuickBooks).

Once you’ve done so, follow the prompts to grant permission for QuickBooks to access your Square account information.

5. You’ll then be asked whichQuickBooks company fileyou want to connect withSquare; select the appropriate file and clickConnect.(If you don’t see your company file listed, make sure you’re logged in to the correctQuickBooksonline account.)

6a. If this is the first time connecting these two accounts, you’ll needto map each income accountinQuickBooksto its correspondingpayment typeinSquare . To do this: UnderMap payment types inthepop-up window ,selectBegin Mapping .

For each row ,underSelect income accountinQuickBooksmatchit upwith its correspondingpayment typeinSquare ,then selectSaveandClose .

![image|690×388]

6b. Ifyou’ve previouslymappedtheseaccountsbefore ,you won’t needto do anythingfurther ;simply selectI’m Donewhenpromptedand clickOK .

![image|690×388]

7a .

Anúncios

How Do I Integrate Square into Quickbooks?

If you’re using QuickBooks to manage your business finances, you can now link it with Square to keep track of your sales and payments in one place. Here’s how to set up the integration:

1. Log in to your QuickBooks account and go to the “Integrations” page.

2. Click on the “Connect” button next to Square.

3. Enter your Square login credentials and click “Allow.”

4. Select whichQuickBooks company file you want to connect with Square, then click “Continue.”

Do I Need Quickbooks If I Have Square?

If you’re a small business owner, you may be wondering if you need QuickBooks if you have Square. The short answer is that it depends on your needs. If you need more comprehensive accounting features, QuickBooks is a good option.

However, if you just need basic bookkeeping features, Square may be all you need.

Here’s a more detailed look at the differences between these two software options to help you decide which is right for your business:

QuickBooks vs. Square: Accounting Features

QuickBooks offers more comprehensive accounting features than Square. For example, with QuickBooks, you can track inventory levels and create invoices. You can also run reports to see your sales, expenses, and profit/loss over time.

This information can be helpful in making strategic decisions about your business.

Square does offer some basic accounting features, such as tracking sales and expenses. However, it doesn’t have as many reporting options as QuickBooks does.

And it doesn’t offer any inventory tracking features. So if you need more robust accounting capabilities, QuickBooks is the better option.

QuickBooks vs Square: Ease of Use

Both QuickBooks and Square are easy to use once they’re set up properly. But setting them up can be different story. With QuickBooks, there’s a bit of a learning curve involved in getting everything set up correctly (especially if you’re not familiar with accounting concepts).

But once everything is set up properly, using the software is fairly straightforward.

Conversely, setting up Square is much simpler since it’s designed for people who don’t have an accounting background (although there are still some things that need to be configured properly).

Anúncios

Credit: www.pinterest.com

Quickbooks And Square Problems

QuickBooks and Square are two popular accounting software programs that small businesses use to track their income and expenses. However, there can be problems when using these two programs together.

For example, if you use QuickBooks to track your sales and then use Square to process your payments, the two systems may not communicate with each other properly.

This can result in discrepancies between your QuickBooks records and your Square records.

To avoid this problem, it’s important to keep both systems up-to-date and in sync with each other. You should also export your data from QuickBooks on a regular basis so that you have a backup in case of any problems.

If you do run into problems when using QuickBooks and Square together, there are a few things you can do to try to fix them. First, check the settings in both programs to make sure they’re configured correctly. Then, try exporting your data from one program and importing it into the other.

Lastly, contact customer support for both programs for further help.

Square Quickbooks Integration Review

If you’re using QuickBooks Online, then you know how important it is to have a streamlined workflow. That’s why the Square Quickbooks integration is so popular. It allows you to automatically sync your transactions from Square into QuickBooks, making accounting a breeze.

But what exactly does this integration do? And more importantly, is it right for your business? Let’s take a closer look in thisSquare Quickbooks Integration Review.

The Square Quickbooks Integration automates the process of recording and categorizing your sales transactions from Square. Once set up, all you need to do is reconcile your books at the end of each month – no more manually entering data! This can save you hours of time each month, which can be better spent on running your business.

In addition to simplifying your accounting, the integration can also help you track inventory levels and costs. This information can be invaluable when making strategic decisions about pricing and product mix. And because all of your data is stored in one place (QuickBooks), it’s easy to generate reports and keep tabs on performance over time.

Overall, the Square Quickbooks Integration is a great tool for businesses that use both platforms (Square and QuickBooks Online). If you’re looking for ways to streamline your workflow and save time on bookkeeping, this could be a perfect solution for you.

Connect to Square

If you’re a business owner, there’s a good chance you’ve heard of Square. Square is a popular point-of-sale system that allows businesses to accept credit and debit card payments. It’s a great option for small businesses because it’s easy to use and relatively affordable.

If you’re thinking about using Square for your business, you’ll need to connect it to your bank account so that you can start processing payments. In this blog post, we’ll show you how to connectSquareto your bank account.

First, you’ll need to sign up for a Square account.

You can do this by visiting the Square website and entering your email address and creating a password. Once you’ve done this, you’ll be taken to the Square Dashboard.

Next, click on the “Settings” tab and then select “Bank Accounts.”

Here, you’ll be able to add your bank account information so thatSquarecan connect to it. Simply enter your routing number and account number and then click “Add Bank Account.”

That’s all there is to it!

Once you’ve connectedSquareto your bank account, you’ll be able to start processing payments right away.

Conclusion

Yes, Square integrates with QuickBooks. You can connect your Square account to QuickBooks Online or QuickBooks Desktop (Pro, Premier, or Enterprise) and export your Square sales data. This allows you to keep track of your sales and inventory in one place.