Are Accounting Software Costs Considered Accounting Expense?

When it comes to accounting, there are a lot of different software options available. The cost of these software programs can range from being completely free to a few thousand dollars. So, the question becomes: Are accounting software costs considered accounting expense?

The answer to this question is both yes and no. If you are using the software for your business, then the cost would be considered an accounting expense. However, if you are using the software for personal use, then the cost would not be considered an accounting expense.

As a business owner, you’re always looking for ways to save money. One area you may be considering is whether or not to outsource your accounting. Accounting software costs can be considered an accounting expense, which means they can be deducted on your taxes.

However, there are some things you need to consider before making this decision.

First, you need to make sure the software you’re using is actually accounting software. There are many different types of software out there, and not all of them will help with your accounting needs.

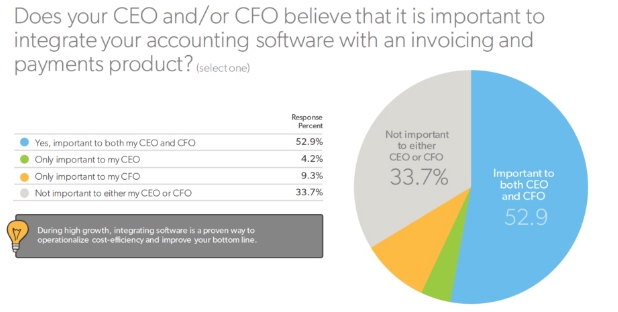

Make sure the software you choose has features like invoicing, tracking expenses, and generating reports.

Second, you need to decide if the cost of the software is worth it. If you’re only spending a few hundred dollars on the software, it may not be worth it in the long run.

On the other hand, if you’re spending thousands of dollars on the software, it’s probably worth the investment.

Third, you need to think about how much time you’ll save by using accounting software. If you’re only saving a few hours each month, it may not be worth it.

However, if you’re saving dozens of hours each month, it’s probably worth the investment.

Fourth, you need to decide if outsourcing your accounting is right for your business model. If you have a complex business with multiple employees and customers, it’s probably best to keep your accounting in-house.

HOW MUCH DOES AN ACCOUNTANT COST IN 2020?

Can Accounting Software Be Capitalized?

Yes, accounting software can be capitalized. This is because it is considered to be a long-term asset, and as such, it meets the criteria for capitalization. The main criteria for capitalization are that the item must have a useful life of more than one year, and it must be used in the production of income.

In addition, the item must be considered to be essential to the business operation.

Anúncios

Can You Capitalize Software Expense?

When it comes to software expenses, the answer is not as straightforward as you may think. For example, if you’re wondering whether you can capitalize the cost of your new accounting software, the answer depends on how you plan to use it.

If the software is considered an integral part of your business, then it can be capitalized as part of your business’ fixed assets.

This means that the expense would be spread out over the life of the software (usually 3-5 years) through depreciation.

On the other hand, if you only use the software for a specific project or one-time event, then it would be treated as a regular operating expense and would not be capitalized.

In either case, it’s important to consult with your accountant to make sure that you’re treating your software expenses in the most advantageous way for your particular situation.

Is Software Purchase an Asset Or Expense?

When it comes to software, the answer to whether it is an asset or expense depends on the type of software being considered. If the software is something that will be used for a long period of time and provides some sort of value-add to your company, then it can be considered an asset. On the other hand, if the software is only going to be used for a short period of time or doesn’t provide any real value-add, then it would be classified as an expense.

In general, most businesses would consider purchase of enterprise software an investment in an intangible asset. The cost is typically capitalized on the balance sheet as part of goodwill when there’s acquisition involved. For example, Microsoft paid $26 billion for LinkedIn and recognized $12 billion as goodwill.

The purchase was accounted for as an intangible asset because Microsoft believes that LinkedIn will help them better connect with their customers and grow their business.

If we look at narrower definition of assets under accounting principles generally accepted in United States (GAAP), intangible assets are “identifiable nonmonetary assets without physical substance”1 That excludes all things with physical presence such as cash, inventory or land but includes copyrights, patents and trademarks which don’t have physical form. Software meets this criteria since once it’s been coded, it only exists digitally.

From GAAP perspective, costs associated with developing or purchasing internal-use software would need to be expensed as incurred because they don’t meet requirements to be capitalized2 . This treatment applies even if you plan to use purchased or developed software indefinitely because its usefulness doesn’t derive from its standalone existence – instead its usefulness comes from how well integrated it is within your larger system3 . For example, let’s say you want to buy customer relationship management (CRM) system.

Even if you never intend to replace that system, costs incurred to get initial functionality out of CRM would need to be treated as expenses4 . However accordingto new revenue recognition standard5 , effective starting 2018 companies will have ability capitalize certain implementation costs associated with getting new systems operational if those systems are necessary for delivering goods or services promised in contract with customer6 . So depending on timing when you incur those costs and nature of your business there may be some opportunity there starting next year onwards7 .

Anúncios

Is Software Development an Expense?

Software development is not an expense. It is an investment.

The main difference between an expense and an investment is that an expense does not generate future benefits, while an investment does.

Software development costs money upfront, but it also generates future benefits in the form of improved productivity, increased efficiency, and new features or functionality.

In other words, software development should be thought of as an investment, rather than an expense. When done right, it will pay off in the long run by making your business more efficient and productive.

Credit: www.patriotsoftware.com

Software License Fees Accounting Treatment

There are a number of different ways that software license fees can be accounted for, depending on the specific circumstances. The most common methods are either to expense the cost in the period it is incurred, or to capitalize it and amortize it over the life of the asset.

If a company decides to expense its software license fees, this means that the cost will be included as an operating expense on the income statement in the period in which it is incurred.

This treatment is typically used for small purchases, or for licenses that will be used up within a short period of time.

If a company decides to capitalize its software license fees, this means that the cost will be recorded as an asset on the balance sheet. The asset will then be amortized over its useful life, which is generally considered to be three to five years.

This treatment is typically used for larger purchases, or for licenses that will provide long-term value to the company.

The accounting treatment chosen should be based on what provides the most accurate representation of financial position and performance. In some cases, companies may choose to use a combination of both methods if they have multiple licenses with different terms and conditions.

Accounting for Software Development Costs Pwc

The global software development services market is expected to grow from $186.6B in 2018 to $292.5B by 2023, at a CAGR of 9.6% during the forecast period (2018–2023). The major drivers for this market’s growth are the need for faster time-to-market, increasing demand for cloud-based solutions, and rise in Agile and DevOps adoption.

However, the accounting for software development costs can be a challenge for many organizations.

This is because there are many different types of costs associated with software development, such as direct costs (e.g., wages of developers), indirect costs (e.g., overhead), and sunk costs (e.g., investments in hardware and software).

Organizations need to carefully consider all of these cost types when making decisions about their software development projects. For example, they need to weigh the benefits of investing in new features or functionality against the costs of developing them.

Additionally, they need to take into account how long it will take to develop certain features or functionality and whether that timeframe is realistic given the resources that are available.

Finally, organizations also need to consider the risks associated with each software development project before making any decisions.

Software License Fees Accounting Treatment Ifrs

When it comes to accounting for software license fees, there are a few different ways that companies can choose to treat them. The most common method is to expense the cost of the licenses as they are incurred. This means that each year, the company will report the cost of any new licenses purchased as an expense on their income statement.

Another way to account for software license fees is to capitalize them and then amortize the costs over time. This treatment is typically used for larger, more expensive licenses that will be used for several years. Under this method, the upfront cost of the license is recorded as an asset on the balance sheet, and then reported as an expense on the income statement in equal installments over the life of the license.

Which accounting treatment you use for software license fees can have a big impact on your financial statements. It’s important to talk with your accountant or financial advisor to determine which method makes sense for your business.

Conclusion

Yes, accounting software costs are considered accounting expenses. This is because these costs are necessary in order to maintain accurate financial records and provide reporting tools for management. Additionally, accounting software can automate many tasks related to bookkeeping, invoicing, and payments processing which can save the business time and money.