What Software Do Tax Accountants Use?

Tax accounting is an area of accounting that deals with the preparation, analysis and reporting of tax payments and liabilities. The software that tax accountants use must be able to handle these tasks in a efficient and effective manner. Some of the most popular software programs used by tax accountants include TurboTax, TaxSlayer and H&R Block.

As a tax accountant, you need to be familiar with a variety of software programs. Here are some of the most popular ones:

1. TurboTax: This is one of the most popular tax preparation software programs out there.

It’s user-friendly and can help you get your taxes done quickly and easily.

2. TaxACT: This program is also very popular, and it offers a lot of features that TurboTax does not. It’s a great choice if you want to explore your options and find the best program for your needs.

3. H&R Block Tax Software: This program is another excellent choice for tax preparation. It’s user-friendly and offers a variety of features to make your job easier.

4. ProSeries Tax Software: This program is designed for professional tax preparers and accountants.

It’s packed with features and can help you get your work done quickly and efficiently.

5. Lacerte Tax Software: This program is another great choice for professional tax preparers. It has all the features you need to get your work done right, and it’s easy to use.

TOP 5 Accounting Software For Small Businesses 2022 – Quickbooks vs xero vs freshbooks vs wave

What Kind of Tax Software Do Cpas Use?

There are many different types of tax software that CPAs can use, and the best type for a CPA to use will depend on their individual needs and preferences. Some of the most popular tax software programs used by CPAs include ProSeries, Lacerte, TaxWise, and UltraTax. Each of these programs offers different features and benefits, so it is important for CPAs to carefully consider their options before deciding which program is right for them.

In general, however, all of these software programs provide an easy way for CPAs to prepare and file taxes electronically.

Anúncios

What Tools Do Tax Preparers Use?

As the tax season approaches, you may be wondering what tools tax preparers use to get the job done. Here is a look at some of the most common tools used by tax professionals:

1. Tax software – This is perhaps the most important tool used by tax preparers.

Tax software helps taxpayers and tax professionals alike to complete and file their taxes with ease. There are many different types of tax software available on the market, so it is important to choose one that best suits your needs.

2. Calculators – A calculator is another essential tool for any tax professional.

From simple calculations to more complex equations, a calculator can help make quick work of any math problem.

3. Reference materials – While not always necessary, reference materials can come in handy when preparing taxes. These materials can include things like IRS publications, state tax forms, and other resources that can provide helpful information during the tax preparation process.

4. Organizational tools – Keeping track of all of the paperwork and documentation associated with taxes can be a daunting task. That’s why it is important to have good organizational tools in place before beginning the preparation process. This might include a filing system, electronic files, or even just a simple notebook to jot down notes and ideas.

5. Communication tools – In today’s world, communication is key no matter what business you’re in-and this includestaxes!

What Software Do Accountants Use?

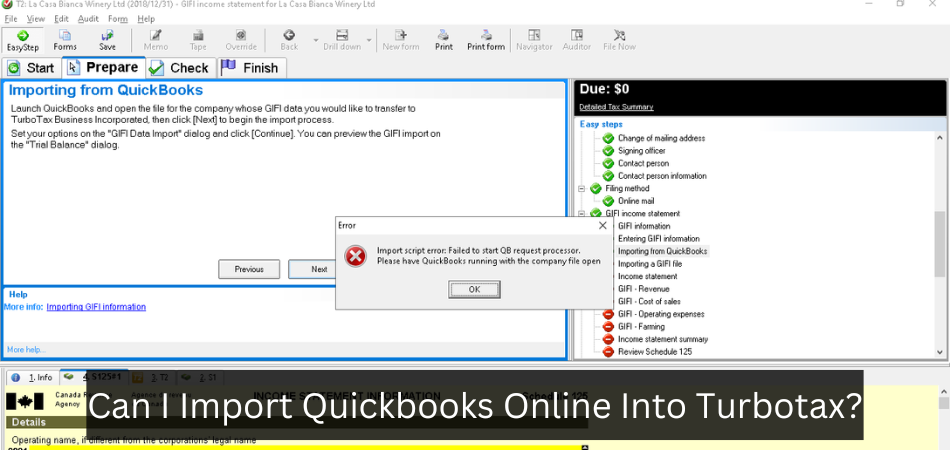

There is a wide range of software that accountants use to help them with their work. The most popular accounting software programs are QuickBooks, Sage 50 and Xero. These programs can help accountants keep track of their clients’ finances, prepare financial statements and reconcile accounts.

Other popular software programs used by accountants include Microsoft Excel, Access and PowerPoint.

Anúncios

Do Cpas Use Software?

Most CPAs use accounting software to perform their job duties. The most popular accounting software programs are QuickBooks, Peachtree and Microsoft Dynamics GP. There are many other accounting software programs available on the market, but these three are the most commonly used by CPAs.

Credit: www.patriotsoftware.com

Which Tax Software is Best for Tax Preparers?

Tax preparers have a lot of options when it comes to tax software. There are many different programs out there, and each has its own strengths and weaknesses. So, which one is the best?

Well, that depends on your needs. If you’re looking for the simplest program with the least amount of features, then TurboTax might be a good choice. However, if you need a more robust program with more features and options, then TaxACT or H&R Block might be better choices.

Ultimately, the best tax software for you is the one that meets your specific needs. So take some time to research the various programs out there and decide which one is right for you.

Tax Software for Professionals Tax Preparers

When it comes to tax software for professional tax preparers, there are a few different options available. The most popular option is probably TurboTax, which offers a variety of features that make it easy to file taxes for both individuals and businesses. However, there are other options out there as well, such as TaxACT and H&R Block.

Each of these software programs has its own strengths and weaknesses, so it’s important to choose the one that best fits your needs. For example, TurboTax is generally considered to be the most user-friendly option, while TaxACT is often lauded for being the most affordable.

No matter which program you choose, though, filing taxes can be a complex process.

That’s why it’s always a good idea to consult with a professional tax preparer before getting started. They can help you navigate the various forms and ensure that you’re taking advantage of all the deductions and credits you’re entitled to.

Best Tax Software for Tax Preparers 2022

As a tax preparer, you have a lot of options when it comes to choosing the best tax software. But with so many choices, it can be hard to know which one is right for you.

To help you make the best decision, we’ve compiled a list of the best tax software for tax preparers in 2022.

We’ve considered factors like cost, ease of use, and features to help you choose the right software for your needs.

1. TurboTax Deluxe: Best Overall Tax Software

TurboTax is one of the most popular tax preparation software programs available, and for good reason.

It’s easy to use, offers a wide range of features, and is very affordable.

TurboTax also offers free phone support if you need help using the software or have any questions about your taxes. And if you’re new to TurboTax, they offer a guided tour that will walk you through each step of the tax preparation process.

2. H&R Block Tax Software Premium & Business: Best Value Tax Software

H&R Block’s Tax Software Premium & Business edition is a great value option for tax preparers. It includes everything you need to prepare taxes for individuals and businesses, including Schedule C forms for businesses with income from self-employment or rental properties.

Conclusion

There are a variety of software programs that tax accountants can use to help them with their work. The most popular of these is probably TurboTax, which is a program that helps users to prepare and file their taxes. Other popular programs include TaxACT and H&R Block At Home.

These programs can help tax accountants to save time on their work, and they can also make it easier for taxpayers to get their taxes done correctly.