What Is the Symbol of PartnerRe?

The symbol of PartnerRe is used to represent the preferred shares of the company. It does not qualify as a stock under securities laws in some jurisdictions. This article provides an overview of these shares. In addition to the common shares, PartnerRe also has preferred shares issued and outstanding.

PRE

PRE is the symbol for the shares of PartnerRe Ltd., a company that provides insurance for companies. The company has issued and outstanding preferred shares. It is not expected to pay a dividend in the next 12 months. However, investors should be aware of its history and how it has changed over time.

The company is based in Bermuda and provides reinsurance coverage to other insurance companies worldwide. The firm offers coverage for various risks including agriculture, aviation, nuclear, space, life, and terrorism. PartnerRe operates under three segments: property, casualty, and engineering reinsurance. It also provides alternative risk products for service and industrial companies.

Anúncios

PartnerRe was originally created by Morgan Stanley, with the help of John Head and Partners, a private investment firm run by a former Morgan Stanley executive. The firm focused on insurance investments, and it eventually hired Swiss Re to join. While Swiss Re was interested in expanding its cat reinsurance business, it was hesitant to take on additional risks on its own balance sheet. Additionally, it wanted to raise capital in the United States through an IPO. But it was hesitant to deal with the Securities and Exchange Commission.

In 1998, PartnerRe decided to diversify into different insurance markets. This move allowed the company to expand beyond cat insurance, resulting in more diversification and greater growth potential. In 1997, the company acquired Societe Anonyme de Reassurances (SAFR), a French reinsurance company. The acquisition of SAFR increased the firm’s customer base from 200 to more than 1,000 and to more than 100 markets worldwide.

Anúncios

Growth

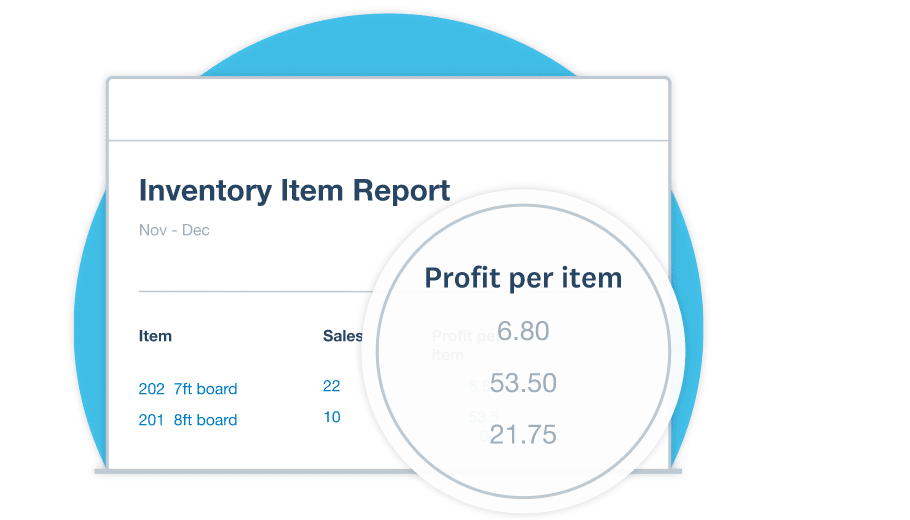

A company’s growth can be measured by its dividend. PartnerRe Ltd.’s dividend history is presented in graphical and chart form, after taking into account known stock splits. This is done to provide the most comparable historical dividend comparison. Using this information, investors can compare the company’s dividend history to other companies and determine long-term growth and volatility.

The company is a leading global reinsurer that provides coverage to primary insurance companies for different risks. Its services range from life and health insurance products to alternative risk products for industrial and service companies. It maintains major offices in Greenwich, Zurich, Paris, and Hong Kong.

In 1997, PartnerRe decided to diversify its business into different insurance sectors. It believed that focusing on cat reinsurance alone was not the best approach. As more companies were entering the cat reinsurance business, premiums were falling and growth prospects were limited. To diversify its product line, PartnerRe acquired SAFR, a French company. SAFR was previously owned by Swiss Re, which owned 22 percent.

Dividends

The Company: PartnerRe Ltd. is a leading global reinsurer, helping insurance companies strengthen their capital and reduce volatility. The Company operates through three segments: property, casualty, and energy. Its total assets and capital are over $23.2 billion. Its shareholders’ equity is $7.2 billion. The company has a high financial strength rating.

Business model

PartnerRe Ltd. is a Bermuda-based company that provides reinsurance and specialty insurance lines. Its subsidiaries include the Partner Reinsurance Company of the U.S. and Europe, and Partner Reinsurance Asia. These companies provide reinsurance solutions for aviation, marine, and property risks. They also help insurance companies strengthen their capital and reduce volatility.

In the most recent quarter, PartnerRe Ltd. reported a loss of $539 million. This is a substantial increase over the $66 million loss that the company reported in the same quarter last year. The loss was largely due to unrealized losses of $821 million, mainly due to increased interest rates.

The materials on this webpage do not constitute an offer to sell or solicitation to buy products or services in any jurisdiction. PartnerRe Capital Management does not offer products or services to retail investors in the U.S. and is not registered with the Securities and Exchange Commission. The information on this webpage is for informational purposes only.

AM Best affirms PartnerRe’s financial ratings and expects no significant deterioration in balance sheet strength in the near future. The company’s life and health reinsurance business continues to generate modest returns. In the interim, AM Best will closely monitor the company’s credit characteristics and will take action if credit characteristics diverge from its previous expectations.