What is the Best Accounting Software for Personal Use?

Anúncios

There are many accounting software programs on the market that cater to personal users. They vary in features, price, and complexity. So, what is the best accounting software for personal use?

The answer depends on your needs and preferences. If you just need to track your income and expenses, then a simple program like Mint or Quicken might be all you need. If you have a small business or rental property, then you might need something with more robust features like TurboTax or QuickBooks.

Whichever program you choose, make sure it meets your needs and is easy for you to use. The last thing you want is to get frustrated with your accounting software and give up on it altogether.

There are many different accounting software programs available on the market today. So, which one is the best for personal use? That really depends on your specific needs and preferences.

If you need something basic that will help you keep track of your income and expenses, then a program like Mint or Quicken may be a good fit for you. These programs are easy to use and offer helpful features like budgeting tools and bill reminders.

If you have a more complex financial situation, or if you’re self-employed, then an accounting program like QuickBooks or Xero may be better suited for your needs.

These programs offer more comprehensive features, such as invoicing, tracking inventory, and managing payroll. They can also be customized to fit the unique needs of your business.

No matter what your accounting needs are, there’s sure to be a software program out there that’s perfect for you.

So take some time to research your options and find the best fit for your personal finances.

Anúncios

TOP 5 Accounting Software For Small Businesses 2022 – Quickbooks vs xero vs freshbooks vs wave

Is There Something Like Quickbooks for Personal Use?

While there is no personal version of QuickBooks, there are a number of other software options available for personal finances. Some popular choices include Mint and Personal Capital. Both of these tools are free to use and offer a variety of features to help you manage your money.

Mint is a budgeting tool that connects to your bank account and tracks your spending. You can see where you are spending your money and set up budgets to help you save. Personal Capital is an investment tracker that helps you track your net worth, investment portfolio, and more.

It also has some budgeting features to help you stay on track with your finances.

Both Mint and Personal Capital are great choices for personal finance management. If you are looking for something similar to QuickBooks, either of these two options will work well for you.

What is the Personal Finance Software?

When it comes to personal finance, there are a lot of software options out there. But what is the best personal finance software? And how do you find the one that fits your needs?

The answer to the first question is difficult to determine. There are a lot of great personal finance software programs available, and the best one for you will depend on your individual financial situation and goals. However, some popular personal finance software programs include Quicken, Mint and You Need a Budget (YNAB).

To find the right personal finance software for you, start by considering what your financial goals are. Do you want to get out of debt? Save for retirement?

Build up your emergency fund? Once you know what your goals are, you can start looking at different software programs and seeing which ones will help you achieve those goals.

Another important consideration is whether or not you want to pay for the software.

There are both free and paid options available, so decide which type is right for you. If you’re just starting out with budgeting or don’t have a lot of money to spare, a free program like Mint may be a good option. But if you’re serious about getting your finances in order and willing to invest in a quality program, something like YNAB may be worth paying for.

Finally, take some time to read reviews of different personal finance software programs before making your decision. Talk to friends or family members who use similar programs and see what they think. Once you’ve found the right program for you, stick with it and use it regularly to help keep track of your finances and reach your financial goals.

Anúncios

Can I Use Quickbooks for My Personal Finances?

While QuickBooks is a great tool for managing business finances, it is not recommended for personal use. There are several reasons for this. First, QuickBooks was designed with businesses in mind, and therefore its features are geared towards business needs.

This can make tracking personal finances more difficult than using a dedicated personal finance software. Second, QuickBooks pricing plans are typically more expensive than those of personal finance software programs. Finally, QuickBooks requires some accounting knowledge to use effectively, whereas personal finance software is usually much simpler and easier to use.

What is the Easiest Bookkeeping Software?

There is a lot of bookkeeping software on the market these days. So, which one is the easiest to use?

In our opinion, QuickBooks Online is the easiest bookkeeping software to use.

Here’s why:

1. It’s web-based, so you can access it from anywhere.

2. It has a clean and intuitive interface that makes it easy to navigate.

3. It offers a wide range of features and tools to help you manage your finances effectively.

4. It integrates with many popular business applications, so you can automate some of your bookkeeping tasks.

Credit: www.how2shout.com

Personal Finance Software

If you’re looking to get your finances in order, you might be considering personal finance software. This can be a great way to stay on top of your budget and make sure you’re not spending more than you can afford. But with so many options out there, how do you choose the right one for you?

Here are some things to consider when choosing personal finance software:

– Ease of use: You want something that’s easy to understand and use, otherwise it won’t be helpful. Look for software with clear instructions and an intuitive interface.

– Budgeting features: Make sure the software has all the budgeting features you need, such as tracking income and expenses, creating a budget, and setting goals.

– Reports: Choose software that provides the reports you need to see where your money is going and how well you’re sticking to your budget.

– Integration: If you already have other financial software or apps, look for something that will integrate well with them.

This can make it easier to keep track of everything in one place.

– Cost: Don’t spend more than you need to on personal finance software – there are plenty of affordable options out there.

Take some time to try out different personal finance software programs until you find one that works well for you and your unique financial situation.

Free Accounting Software for Personal Use

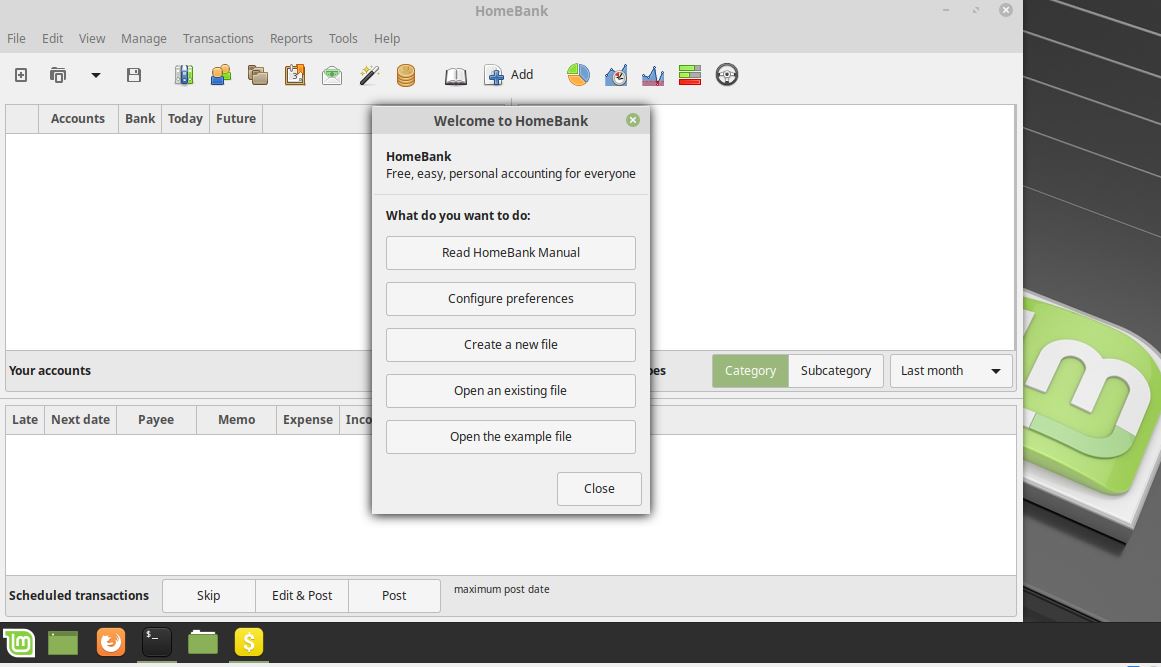

When it comes to managing your finances, there are a lot of different software programs out there that can help. But if you’re looking for something that won’t cost you anything, there are some great free accounting software options available.

One popular program is GnuCash.

It’s designed to be easy to use, and it offers a wide range of features including double-entry bookkeeping, bank account reconciliation, and more. There’s also a handy mobile app so you can stay on top of your finances while you’re on the go.

Another option is Wave Accounting.

This program is geared towards small businesses, but it can be used for personal finances as well. Wave Accounting offers invoicing, expense tracking, and other features that can help you keep tabs on your money.

If you’re not sure which program is right for you, it’s worth taking some time to try out a few before settling on one.

That way, you can find the one that best fits your needs and budget.

Best Free Personal Finance Software

There are many personal finance software programs available, but not all of them are free. Here is a list of the best free personal finance software programs currently available:

1. Mint: This popular program from Intuit offers budgeting, bill tracking, and credit score monitoring, all in one place.

Mint is web-based and mobile-friendly, making it easy to track your finances on the go.

2. Personal Capital: This program focuses on investment tracking and analysis, helping you to make better decisions about where to invest your money. Personal Capital is web-based and also has a mobile app.

3. YNAB (You Need a Budget): This budgeting program helps you to create a monthly budget and stick to it. YNAB is available for desktop computers, as well as iOS and Android devices.

Conclusion

When it comes to choosing accounting software for personal use, there are many factors to consider. However, the three most important factors are ease of use, features, and price.

Ease of use is important because you want to be able to quickly and easily enter your transactions and generate reports.

The software should also have a user-friendly interface.

Features are important because you want to make sure the software has all the features you need. For example, if you plan on tracking investments, you’ll want to make sure the software has investment tracking capabilities.

Price is also important because you don’t want to spend more than you have to.

There are many different accounting software programs available, so take some time to compare them before making a decision. Once you find the right one for you, keeping track of your finances will be a breeze!