Money saving apps: Best tips for 2024

Anúncios

In times of financial instability and rising living costs, finding effective ways to save money is a priority for many.

Fortunately, technology is on our side, and several apps have been developed to help people better manage their finances and save money intelligently.

Anúncios

To help you find the right app, we’ve gathered some tips on money-saving apps that can assist you.

If you’re looking for money saving apps, keep reading to find the best one for you!

Anúncios

Why use money saving apps?

Using money saving apps is an excellent way to automate the savings process, making it easier to build healthy financial habits.

With these apps, you can track your expenses, set savings goals, and even earn rewards for making smart financial decisions.

Many of these apps offer valuable insights into your spending habits, allowing you to make adjustments that can result in significant savings over time.

Financial apps also stand out for their convenience. With them, you can monitor your savings anytime, anywhere, making the process more accessible.

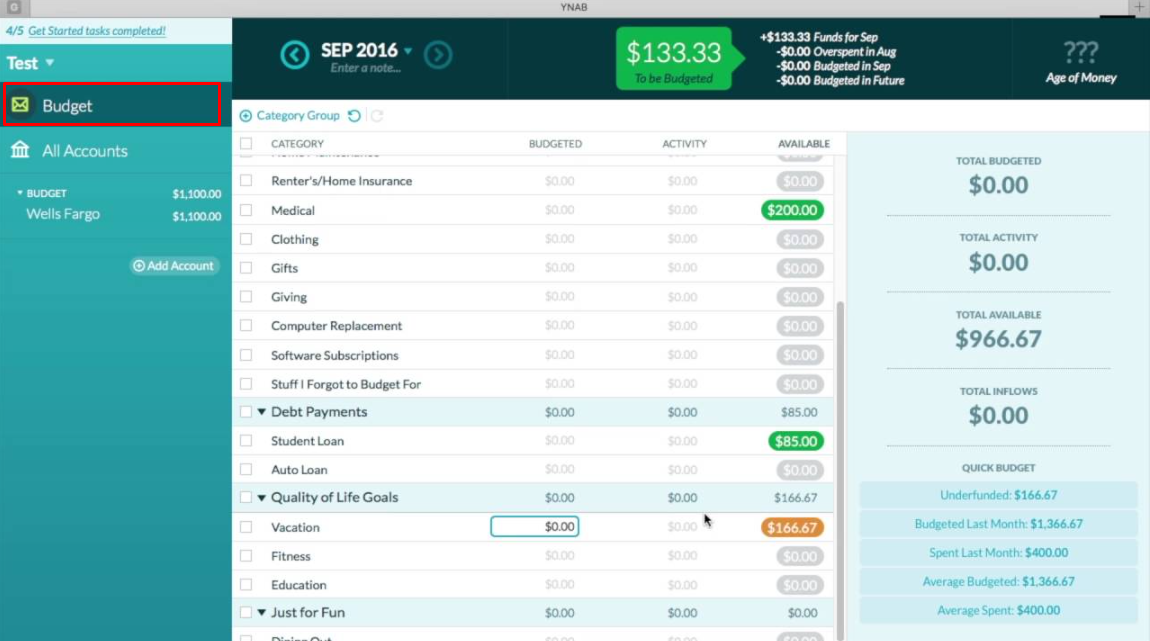

Options of money saving apps

Now that you understand why using apps to save money is beneficial, let’s explore some options.

Chime

Chime is a digital bank offering various features designed to help you save. One of its key features is “Save When You Get Paid”, which automatically transfers a portion of your paycheck to a savings account as soon as you get paid.

Another helpful feature is “Save When You Spend,” which rounds up your purchases to the nearest dollar and deposits the difference into your savings.

Additionally, Chime charges no maintenance or ATM fees at partnered networks, contributing to long-term savings.

For those seeking simplicity and effectiveness, Chime is an excellent option. It also offers early paycheck access, providing better cash flow management.

Acorns

If you’re interested in investing while saving, Acorns might be the perfect tool. Acorns stands out for its “round-up investment” feature, which rounds up your daily purchases to the nearest dollar and invests the difference in a diversified portfolio.

Acorns offers several investment account options, including retirement accounts, making it a smart choice for those who want to save and invest for the future simultaneously.

It also provides educational content to help users learn more about investments and personal finance.

Though the app charges a small monthly service fee, many users see this cost as a worthwhile investment for the convenience and potential returns it offers.

Oportun

Oportun is designed to assist people with limited access to traditional financial services. In addition to savings accounts, it provides personal loans with competitive rates.

The app simplifies saving through an intuitive interface and also offers financial education tools.

Oportun’s main advantage is that it enables users with limited or no credit history to access credit while also building or improving their credit score over time.

This makes Oportun a valuable choice for those looking to consolidate their personal finances while working to improve their financial health.

Rocket Money

Previously known as Truebill, Rocket Money is a comprehensive financial management platform.

It helps users identify and cancel unnecessary subscriptions, renegotiate bills, and monitor expenses, all within a single app.

One popular feature is the automatic bill negotiation service, which can help reduce monthly expenses like internet and cable bills, saving users money proactively.

Beyond cost-cutting, Rocket Money offers a detailed view of your finances, allowing you to identify spending patterns and create more effective savings plans.

If you often lose money on unused subscriptions or services, Rocket Money is an ideal solution.

Qapital

Qapital offers a more flexible and personalized approach to savings.

Users can create custom savings rules, such as setting the app to transfer a certain amount to savings every time they make a payment or achieve a step goal.

It also includes investment options, making it suitable for both short-term savings and long-term financial goals. Qapital is highly recommended for those who enjoy customizing their savings experience.

With its intuitive interface and goal-focused design, Qapital makes saving fun, interactive, and effective.

Allo

Allo is relatively new to the market but has already gained popularity for its innovative approach.

This app focuses on collaborative saving, allowing groups of friends or family members to pool money for shared goals, such as vacations or special gifts.

Each participant can set their contribution, and the app keeps everyone updated on the progress.

Allo’s unique concept is perfect for those who prefer saving in groups, whether to achieve a shared goal or simply to keep each other accountable for financial objectives.

Current

Current is a digital bank offering several benefits for those who want to save without sacrificing flexibility.

One standout feature is “Savings Pods,” which allows users to create sub-accounts for specific goals, such as vacations, big purchases, or emergencies.

Current also offers up to 4.00% APY on savings accounts, a rate much higher than many traditional banks.

Another significant benefit is early paycheck access, allowing users to receive deposits up to two days before the usual payday.

With its intuitive interface and range of financial tools, Current is an excellent choice for those seeking simple and effective ways to save.

The variety of money saving apps available today offers options for different financial profiles and needs.

From Chime, which automates savings, to Acorns, which allows you to invest while saving, these apps have the potential to transform how you manage your finances.

Whether you’re looking for an app to track expenses, cancel unnecessary subscriptions, or save in groups, there is a perfect option for you.

Choosing the right app depends on your personal financial goals. Explore the features of each one, find the one that fits your lifestyle best, and start saving smarter in 2024.