Is Ynab Worth It?

Anúncios

I have recently started using Ynab and I am really liking it so far. It is very user-friendly and has helped me to get a better handle on my finances. I was wondering if anyone else has used Ynab and what their thoughts are?

Is it worth the monthly subscription fee?

If you’re looking for a budgeting tool that can help you get your finances in order, you may be wondering if Ynab is worth it. The short answer is yes! Ynab can be an extremely helpful tool for managing your money and helping you to stay on track with your financial goals.

Here’s a closer look at what Ynab has to offer and why it could be worth the investment:

1. You’ll Have a Better Understanding of Your Money

With Ynab, you’ll have a clear picture of where your money is going each month.

This can help you to make more informed spending decisions and cut back on unnecessary expenses. When you have a better handle on your finances, it can also lead to reduced stress levels overall.

2. You Can Save More Money

By using Ynab, you can set aside money each month for specific savings goals. This will help you to make headway on things like building up an emergency fund or saving for a big purchase down the road. Having this extra cash available can give you peace of mind and make it easier to stick to your budget overall.

3 .YouCan Pay Off Debt Faster One great way to use Ynab is to create a plan for paying off debt faster . When you know exactly how much money you need to put towards debts each month, it becomes easier to focus on that goal and make progress.

This debt-reduction strategy can save you money in interest charges over time and help get your finances back on track sooner rather than later . Overall , Ynab can be an excellent tool for taking control of your finances . If staying organized , reducing stress , saving money , or paying off debt are priorities foryou , giveYnabad try today !

Anúncios

YNAB Review 2022 – The Best Budgeting Apps

Is Ynab Worth It Reddit

If you’re looking for a budgeting tool, you may have come across YNAB (You Need A Budget). It’s a popular tool, but is it worth the price?

Here’s what people are saying on Reddit about YNAB:

“I’ve been using YNAB for about 6 months now and I absolutely love it. It has helped me get a handle on my finances and has saved me money.” -u/amandanicole0415

“I just started using YNAB last month and I love it! I’m finally able to see where all of my money is going and I’m already saving more.” -u/emilyrose1717

“I’ve been using YNAB for years and it’s definitely worth it. It’s helped me stay on track with my finances and has saved me a lot of money.” -u/mrsdavis0311

Overall, it seems like people who have used or are currently using YNAB would recommend it. If you’re struggling to stick to a budget, or if you want to get better at knowing where your money is going, YNAB could be worth checking out.

Is Ynab Worth It Reddit 2022

If you’re like most people, you probably have a love-hate relationship with money. You want to save, but you also want to spend. And when it comes to budgeting, it can be hard to find a system that works for you.

Enter YNAB, or You Need a Budget. This budgeting app is designed to help you take control of your finances and finally get ahead. But is YNAB worth it?

Let’s take a look at what the app has to offer and see if it’s right for you.

YNAB starts by having you set up your account with your income, debts, and expenses. Then, it gives you two options for budgeting: the envelope system or the zero-based budget.

With the envelope system, each dollar is assigned to a specific category (think: food, entertainment, savings), and when the money in that category runs out, you’re done spending for the month. With the zero-based budget, every dollar has a job – whether it’s paying off debt or being saved for a rainy day – so you always know where your money is going.

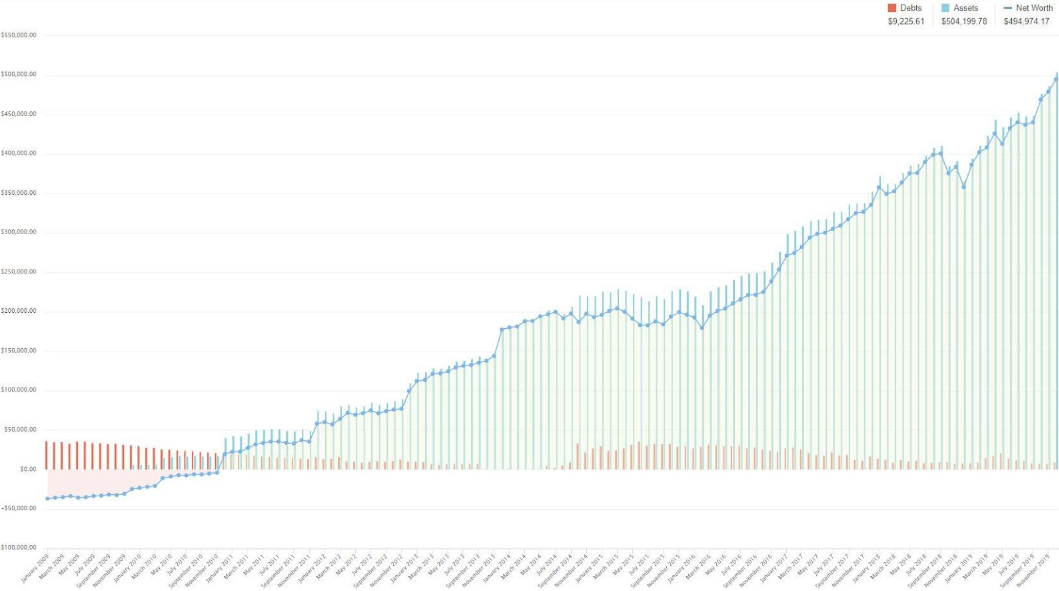

Once you’ve chosen yourbudgeting method, YNAB helpsyou stay on track by givingyou tools like reportsand graphs that showwhere your moneyis going and howmuch progressyou’re makingtoward your financialgoals.

You canalso connectyour bankaccountto YNAB sothat transactionsare automaticallyimported andcategorized – no moremanual data entry!Plus, there’sa handy mobileapp soyou can keep tabs onyour financeson the go.

So…is YNAB worthit?

If you’re lookingfor a comprehensivebudgeting solutionthat will helpyou take controlof your financesand finally getahead financially,then we thinkthe answer isa resounding yes!

Anúncios

Is Ynab Free

Ynab, or You Need A Budget, is a popular budgeting software that has helped hundreds of thousands of people get their finances in order. The program is designed to help you create and stick to a budget so that you can save money and reach your financial goals. Ynab is available for both desktop and mobile devices, and there is a free trial period so that you can try out the program before committing to it.

While Ynab is not free, it is very affordable at just $5 per month (or $50 per year if you choose to pay upfront). This price includes access to all of the features of the program, as well as customer support. There is also a free version of Ynab available, but it has limited features and does not include customer support.

If you are serious about getting your finances in order, we recommend upgrading to the paid version of Ynab.

Ynab Vs Mint

It can be difficult to choose the right budgeting tool. There are many different options available and it can be hard to know which one is best for you. In this blog post, we’ll compare two of the most popular budgeting tools: Ynab and Mint.

Ynab is a budgeting tool that focuses on helping you achieve your financial goals. It allows you to create a custom budget and track your progress over time. You can also connect your bank account to Ynab so that it can automatically import your transactions.

Mint is a budgeting tool that gives you an overview of your finances. It shows you where you’re spending your money and where you can save money. Mint also offers features such as bill tracking and credit score monitoring.

Credit: www.cashfortacos.com

What are the Pros And Cons of Ynab?

There are a lot of pros to YNAB (You Need A Budget). Perhaps the biggest pro is that it forces you to be mindful of your spending. When you have to enter every transaction manually, it makes you think about whether or not you really need to make that purchase.

This can lead to big savings over time.

Another pro is that YNAB can help you get out of debt. By following the rules and sticking to your budget, you can pay off your debts and become debt-free.

This will save you money in the long run and improve your financial health overall.

finally, YNAB can help simplify your finances. If you’re someone who struggles with keeping track of their spending, this budgeting system can help streamline things and make it easier for you to see where your money is going each month.

Now let’s take a look at some of the cons of YNAB. One downside is that it requires a bit of work on your part. You have to be diligent about entering all of your transactions and making sure that everything balances out at the end of the month.

If you’re not careful, it’s easy to miss something and end up overspending or getting behind on payments.

Another potential con is that YNAB can be inflexible at times. If unexpected expenses come up or if you want to splurge on something special, it can be difficult to do so without breaking your budget.

This isn’t necessarily a bad thing – after all, one of the goals of using a budget is learning how to stick to it – but it’s something to keep in mind if flexibility is important to you.

Why is Ynab So Popular?

YNAB, or You Need a Budget, is one of the most popular budgeting apps on the market. And for good reason! YNAB is designed to help you get out of debt and save money.

Here’s how it works: you connect your bank account to YNAB and enter your income and expenses. YNAB then gives you a budget to follow each month. The goal is to “live off last month’s income,” which means you save up money each month so that you can cover your expenses the following month.

This system forces you to be mindful of your spending and helps you break the cycle of living paycheck-to-paycheck.

YNAB also offers helpful features like tracking your progress toward financial goals, setting up Debt payoff plans, and connecting with a community of like-minded people who are working to improve their finances.

If you’re looking for a budgeting app that will help you get out of debt and start saving money, YNAB is definitely worth checking out!

Does Ynab Actually Move Money?

YNAB, or You Need a Budget, is a budgeting software that allows users to track their spending and save money. One of the features of YNAB is that it can automatically move money from your checking account to your savings account. This can be a great way to save money, but it’s important to understand how it works before you get started.

When you set up YNAB, you’ll link your checking and savings accounts. You’ll also need to set up a budget and decide how much you want to save each month. Once everything is set up, YNAB will automatically transfer the amount you’ve specified into your savings account each month.

There are a few things to keep in mind when using this feature. First, make sure you have enough money in your checking account to cover the amount you’re transferring. If not, you could end up overdrawing your account and incurring fees.

Second, remember that it may take a few days for the transfer to go through, so don’t expect the money to be immediately available in your savings account.

Overall, YNAB can be a great tool for saving money if used correctly. Just be sure to understand how it works before getting started so that you can avoid any unwanted surprises down the road!

What is Better Mint Or Ynab?

There is no easy answer when it comes to finding the best budgeting method for you and your family. However, if you are looking for a tool that will help you better manage your money, then you may want to consider using YNAB (You Need A Budget). YNAB is a budgeting system that focuses on giving every dollar a job.

This means that every time you receive money, you need to assign it to a specific category in your budget. This can help prevent overspending and help you better save for future expenses.

While Mint is also a popular budgeting tool, it does not offer the same features as YNAB.

Mint focuses more on tracking your spending habits and providing insights into where you are spending your money. While this information can be helpful, it may not be as effective in helping you stick to a budget.

If you are looking for a tool that will help you better manage your finances, then YNAB may be the better option for you.

However, if you are simply looking for insights into your spending habits, then Mint may be a better option.

Conclusion

Is Ynab Worth It is a personal finance blog that discusses the pros and cons of using the software. The author provides an in-depth analysis of whether or not the software is worth the price, based on their own experience. They conclude that while Ynab may not be perfect, it is still a valuable tool for managing finances.