What is early direct deposit, and how can it benefit you?

Anúncios

With early direct deposit, you can access your hard-earned money up to two days ahead of schedule, giving you more control over your financial planning.

Getting your paycheck sooner can be a game-changer for managing your finances.

Anúncios

But what is early direct deposit, and how does it work? In this guide, we explain how this banking feature works, the benefits it offers, and how you can set it up.

By the end, you’ll understand why choosing banks can help you better manage your money.

Anúncios

What is early direct deposit?

It is a feature that allows you to access your paycheck or benefit payments before the standard payday.

Unlike traditional direct deposits, which are typically available on the official payday set by your employer or benefits provider, early direct deposit provides funds as soon as the bank receives the payer’s deposit notification.

This process is made possible through the Automated Clearing House (ACH) network, which facilitates electronic fund transfers.

For employees, this means you can get your paycheck up to two days earlier, depending on your financial institution.

Similarly, if you receive Social Security benefits or tax refunds, can give you quicker access to these payments.

With banks offering early direct deposit, you can break free from rigid payment schedules and take control of your finances.

How does early direct deposit work?

Depends on how banks handle incoming payments. When an employer or government agency initiates a direct deposit, they send payment details to the receiving bank.

Traditional banks may hold the funds until the scheduled payday, even if the ACH transfer has been processed.

However, banks with early direct deposit release funds as soon as they receive the deposit notification, enabling you to access your money as soon as it’s available.

For this to work, your bank must support early direct deposit and process ACH transactions promptly.

By choosing a bank that offers this feature, you ensure faster access to your funds, allowing you to meet your financial obligations earlier than usual.

This convenience can make a significant difference, especially for individuals living paycheck to paycheck.

Which institutions offer early direct deposit?

Many modern financial institutions, particularly online banks and credit unions, have adopted early direct deposit to attract customers.

Digital banks like Chime, Current, and Varo are pioneers in offering this feature, prioritizing customer-centric services with minimal fees.

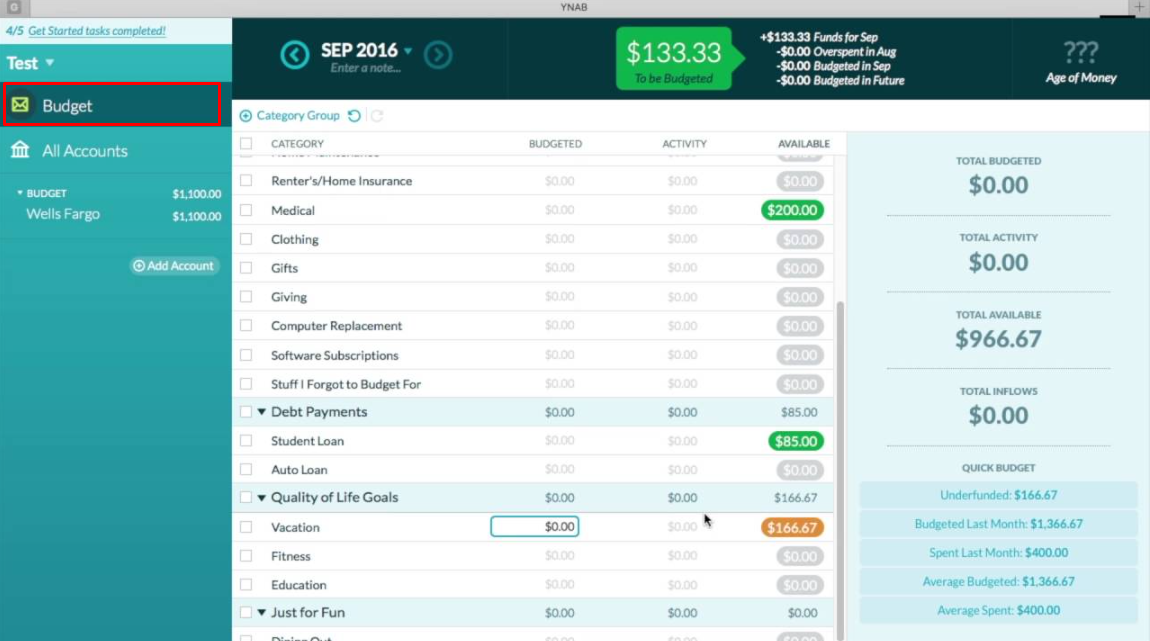

Traditional banks like Chase and Wells Fargo are also starting to provide early access to direct deposits as part of their offerings.

These banks typically include early direct deposit as a free feature, making it an attractive choice for customers seeking convenience without extra costs.

Before opening an account, confirm with the bank if they support early direct deposit and inquire about any conditions or limits associated with the service.

Benefits of early direct deposit

It offers several advantages, making it a valuable feature for managing your finances. Here’s a closer look at its main benefits:

Avoid payment delays

Receiving payment earlier can help you avoid missing bill deadlines, which often lead to penalties or late fees.

With early direct deposit, you gain access to your funds sooner, enabling you to meet rent, utilities, and other essential payment deadlines on time.

This proactive approach can improve your financial stability and credit score over time.

Avoid late fees

Overdraft fees and insufficient fund charges can add up quickly if your account runs out of money before payday.

By accessing your paycheck early, you can maintain a positive balance and avoid these costly fees.

Banks with early direct deposit empower customers to stay ahead of financial obligations, saving you unnecessary charges and preserving your hard-earned money.

Better financial planning

Early access to your income allows for better budgeting and financial planning.

Knowing your funds will arrive earlier helps you allocate money more effectively for savings, bills, and other expenses.

This enhanced predictability reduces financial stress and promotes healthier money management habits.

Earn more interest with high-yield savings accounts

If you use a high-yield savings account, depositing money earlier means you start earning interest sooner.

Even a few extra days can translate into significant gains over time. Early direct deposit lets you optimize your savings strategy and maximize returns on your funds.

Everyday convenience

For many, the most notable benefit of early direct deposit is the convenience it offers. Having funds available earlier simplifies daily expenses, from grocery shopping to emergency needs.

This feature eliminates the hassle of waiting for payday, making it easier to manage your financial life efficiently.

How to set up early direct deposit

Setting up early direct deposit is simple but requires a few steps to ensure everything goes smoothly:

- Confirm eligibility with your bank: Verify that your financial institution offers early direct deposit, and confirm that your account type includes this option.

- Provide your employer with your banking information: Share your bank account and routing numbers with your employer or benefits provider. These details are usually found in your banking app or account statement.

- Check deposit timing: Speak with your employer or benefits provider to confirm when deposits are sent and ensure early direct deposit is set up correctly.

- Monitor your account: After setup, check your account regularly to verify deposits arrive before the scheduled payday.

By following these steps, you can transition seamlessly to early direct deposit and enjoy faster access to your income.

What’s the difference between early direct deposit and online payday advances?

Early direct deposit is often confused with online payday advance services, but the two are fundamentally different.

Early direct deposit is a free feature offered by many banks, allowing you to access your money early without incurring fees or taking on debt.

It relies on rapid processing of deposits, ensuring funds are yours as soon as they’re received.

In contrast, payday advances involve borrowing money against your next paycheck. These services usually come with fees or interest, making them a more expensive option for accessing funds.

Moreover, payday advances are temporary solutions, while early direct deposit is a sustainable, cost-free benefit directly linked to your banking relationship.

By choosing banks with early direct deposit, you can avoid the downsides of loans and build a stronger financial foundation. It is a simple yet powerful tool that can transform how you manage your finances.

By giving you access to your funds up to two days early, it helps you avoid late fees, stay on top of bills, and improve your overall financial planning.

With so many banks offering early direct deposit, it’s easier than ever to find an institution that aligns with your needs.

Ready to take control of your financial future? Explore our site for more tips and insights and discover how it can help you achieve greater financial freedom.

Start enjoying the benefits of access to your money today! Need a suggestion? Check out our content explaining how health savings accounts work!