Do Startups Need Accounting Software?

In the early days of a startup, the founders usually wear many hats. They may be responsible for sales, marketing, product development, and even accounting. As the company grows and brings on additional staff, the founders can start to focus on their core competencies and delegate other tasks.

One task that is often delegated is accounting. But do startups really need accounting software?

No matter what industry you’re in, bookkeeping and accounting are essential to the success of your startup. Whether you’re a one-person operation or have a team of employees, tracking your finances is key to making informed business decisions, achieving goals, and growing your company.

There are many different types of accounting software on the market, so it’s important to choose the right one for your needs.

If you’re not sure where to start, here are four things to look for in accounting software for startups:

1. Ease of Use: Startups need accounting software that is easy to use and understand. Look for software with a user-friendly interface that requires minimal training to get started.

2. Flexibility: As your startup grows, so will your financial needs. Choose accounting software that is scalable and can grow with you.

3. Automation: Automating repetitive tasks like invoicing and payments can save you time and money.

Look for software that offers features like online bill pay and automatic payments.

4. Reporting: Make data-driven decisions with comprehensive reporting capabilities.

Accounting 101: What you need to know as a startup | Xero

Do Startups Need Accountants?

There is no one-size-fits-all answer to this question, as the accounting needs of startups vary depending on the type and size of the business, as well as its stage of development. However, in general, it is advisable for startups to have at least some basic accounting knowledge and to hire an accountant or bookkeeper to handle their finances.

One of the most important things for any business, regardless of size, is to keep track of its income and expenses.

This allows businesses to see where they are making and losing money, and make informed decisions about how to allocate their resources. For startups that are still in the early stages of development, it may be sufficient to simply maintain a spreadsheet with records of all incoming and outgoing funds. However, as the business grows and becomes more complex, it will become increasingly difficult (and time-consuming) to manage finances without professional help.

An accountant can provide a number of valuable services for a startup business. They can help to set up financial systems and controls, prepare accurate financial statements, file taxes properly (and on time), advise on financial matters such as funding options and investment strategies, and offer general support during times of growth or crisis. In short, an accountant can be an invaluable asset for any startup that wants to stay on top of its finances and make sound long-term decisions about its money.

Anúncios

Is It Necessary to Have Accounting Software?

There is no one-size-fits-all answer to this question, as the necessity of accounting software depends on the specific needs of your business. However, in general, accounting software can save you time and money by automating repetitive tasks, providing accurate financial reports, and simplifying tax compliance. If you are currently manually tracking your finances using spreadsheets or pen and paper, investing in accounting software may be a wise decision.

How Do I Manage Startup Accounts?

Assuming you are referring to financial accounts for a startup business, there are a few key things to keep in mind. First, it is important to track all income and expenses carefully. This will give you a clear picture of the financial health of your business.

Second, keep your personal and business finances separate. This will help you stay organized and avoid any potential legal problems down the road. Finally, make sure to set aside money for taxes.

Paying taxes can be one of the biggest challenges for small businesses, so it is important to plan ahead.

Anúncios

What is the Best Online Accounting Service for Startups?

There are a lot of different accounting software programs out there, and it can be tough to decide which one is right for your startup business. The best online accounting service for startups will depend on a few different factors, including the size of your business, your budget, and the features you need.

If you’re just starting out, you may not need all the bells and whistles that come with some of the more expensive accounting software programs.

In that case, something like Wave Accounting could be a good option. It’s free to use and has all the basic features you’ll need to get started.

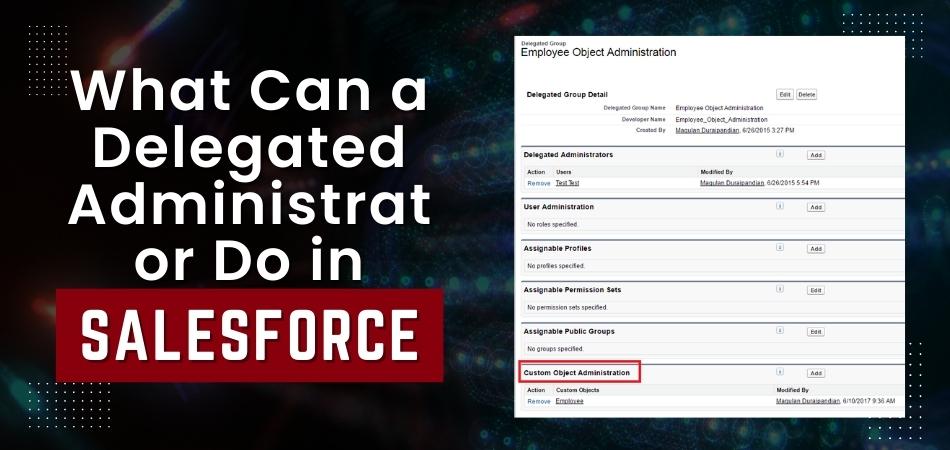

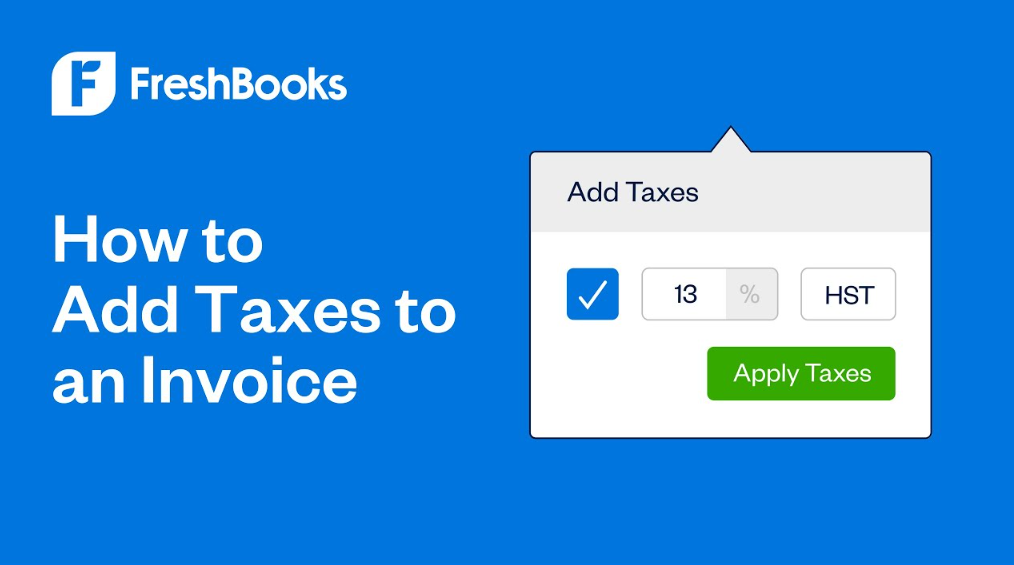

As your business grows, you’ll likely need more advanced features, such as invoicing and tracking inventory.

At that point, you may want to consider upgrading to a paid program like FreshBooks or QuickBooks Online. Both of these have fairly reasonable monthly rates and offer a wide range of features.

No matter what accounting software you choose for your startup business, make sure it’s something that will grow with you as your company expands.

That way, you won’t have to switch programs down the road and can keep all your financial information in one place.

Credit: www.lightercapital.com

Startup Accounting Software

If you’re starting a business, one of the first things you need to do is set up your accounting software. This will help you track your income and expenses, and keep everything organized as your business grows.

There are a lot of different accounting software programs out there, so it’s important to choose one that’s right for your business.

You’ll want to consider features like invoicing, tracking inventory, and generating reports. And of course, price is always a factor.

Once you’ve selected the perfect accounting software for your startup, be sure to take the time to learn how to use it properly.

This will save you a lot of headaches down the road!

Best Accounting Software for Startups

If you’re a startup, choosing the best accounting software is crucial to your success. The right accounting software will save you time and money, and help you stay organized and compliant with regulations.

There are many different accounting software programs on the market, so how do you know which one is right for your business?

Here are some things to consider when choosing accounting software for your startup:

1. Ease of use. The last thing you want is complex software that takes forever to learn how to use.

Look for something that’s intuitive and easy to navigate.

2. Affordability. Startups don’t have a lot of extra cash lying around, so it’s important to find an affordable solution that fits within your budget.

Don’t sacrifice quality for price, but keep in mind that there are many high-quality options available at an affordable price point.

3. Functionality. Make sure the software you choose has all the features and functionality you need to run your business effectively.

If you’re not sure what you need, ask a professional or consult with other businesses in your industry to see what they’re using and why they love (or hate) it.

4 Scalability . As your business grows, so will your needs from an accounting standpoint .

Choose software that can grow with you , so you don’t have to start from scratch again down the road .

Free Accounting Software for Startups

There are a lot of accounting software options out there, but which one is the best for startups? The answer may surprise you – it’s actually free accounting software!

That’s right, there are a number of quality free accounting software options available that can help your startup get off on the right foot financially.

Here are just a few of the top free accounting software programs to consider:

1. GnuCash – This powerful open-source program is ideal for small businesses and startups. It offers double-entry bookkeeping, invoicing, reporting, and more.

2. Wave Accounting – Wave is a great option for businesses that need simple yet effective accounting tools. It offers invoicing, payments, payroll, and financial reports. Plus, it integrates with other popular business tools like PayPal and Xero.

3. ZipBooks – ZipBooks is perfect for businesses that want beautiful invoices and online payment processing. It also includes automatic expense tracking and integrations with popular business apps like QuickBooks Online and Freshbooks.

Conclusion

The post discusses whether startups need accounting software and provides pros and cons for using accounting software. The author ultimately concludes that while there are benefits to using accounting software, it is not a necessity for every startup.