Can Salesforce Be Used for Accounting?

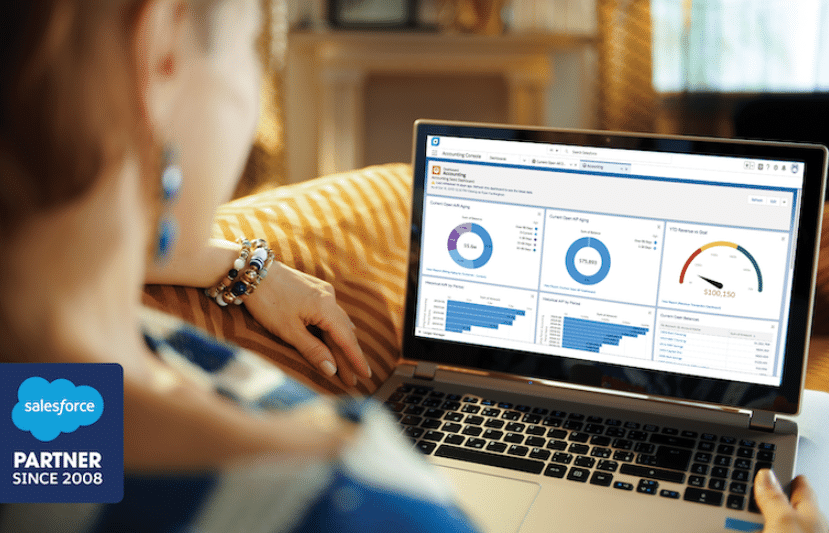

Salesforce is a powerful CRM tool, but can it be used for accounting purposes? The answer is yes! While Salesforce was not originally designed for accounting, it has the features and functionality that make it a great option for small businesses.

Here are some of the ways that Salesforce can be used for accounting:

Invoicing: With Salesforce, you can create and send invoices directly to your customers. This feature makes billing and invoicing quick and easy.

Quotes: Need to provide a quote to a potential customer? Salesforce lets you create quotes and track them in the system so you can see the status of each one.

Budgeting: Planning your budget is important for any business, and Salesforce can help.

The system lets you track your income and expenses so you can see where your money is going.

Salesforce is a popular CRM tool, but can it be used for accounting purposes? The answer is yes! Salesforce has many features that make it ideal for managing finances.

For example, the software can track invoices and payments, helping you stay on top of your receivables. Additionally, Salesforce can help you manage your expenses by tracking bills and vendor information. Overall, Salesforce is a great option for small businesses that need to keep track of their finances in one place.

Credit: teamheller.com

Anúncios

Is Salesforce a Quickbooks?

Salesforce is not a QuickBooks. While both are CRM (customer relationship management) software, they have different functions. QuickBooks is accounting software that helps businesses track their income and expenses, while Salesforce helps businesses manage their customer relationships.

Does Salesforce Have Accounts Receivable?

Salesforce does have accounts receivable! This feature is part of the Salesforce Platform, which allows businesses to manage their sales, marketing, and customer service operations in one place. Accounts receivable is a critical part of any business, and Salesforce provides users with the tools they need to track and manage their receivables effectively.

With Salesforce, businesses can easily see who owes them money, how much money is owed, and when payments are due. They can also set up automated reminders for customers who are behind on their payments.

Anúncios

Is Financialforce Part of Salesforce?

As of September 2019, FinancialForce is now a part of Salesforce. FinancialForce was founded in 2009 and is headquartered in San Francisco. It is a cloud-based ERP software that runs on the Salesforce1 Platform.

FinancialForce provides solutions for accounting, billing, collections, expense management, and revenue recognition. It also offers professional services automation (PSA) and human capital management (HCM) solutions. In addition, FinancialForce has built several industry-specific applications such as for media and advertising, nonprofit organizations, and healthcare providers.

The acquisition will enable Salesforce to offer an end-to-end financial management solution to its customers. FinancialForce’s products will complement Salesforce’s existing offerings in sales force automation (SFA), customer relationship management (CRM), and platform as a service (PaaS).

Does Salesforce Own Accounting Seed?

Salesforce does not own accounting seed. However, they have partnered with them to provide an integrated solution for customers. This partnership provides customers with a complete view of their financial data within Salesforce.

Can I do accounting in Salesforce?

Native Salesforce Accounting

Salesforce is a powerful CRM tool that can help your business streamline its sales process. In addition to sales automation, Salesforce also offers accounting features that can save your business time and money. With Native Salesforce Accounting, you can manage your finances directly within Salesforce, eliminating the need for separate accounting software.

This blog post will provide an overview of how Native Salesforce Accounting works and how it can benefit your business.

Native Salesforce Accounting is a cloud-based accounting solution that integrates with your Salesforce CRM system. With this solution, you can manage all of your financial transactions within Salesforce, including invoicing, payments, and expense tracking.

This eliminates the need for separate accounting software, which can save your business time and money. In addition, Native Salesforce Accounting offers real-time visibility into your financial data, so you can make informed decisions about where to allocate resources.

If you’re looking for a way to streamline your sales process and improve your bottom line, consider implementing Native Salesforce Accounting at your company.

It’s an affordable solution that can save you time and money in the long run!

Salesforce Accounting Jobs

Salesforce is a cloud-based CRM software that helps businesses keep track of their customers and sales. Many businesses use Salesforce to manage their accounting and financial data, so there is a growing demand for professionals who are familiar with Salesforce and can help companies make the most of its features.

If you’re looking for a challenging and rewarding career in accounting, then a job working with Salesforce could be a great option for you.

As a Salesforce accountant, you would be responsible for helping businesses keep track of their finances and performance using the software. You would need to have strong analytical skills and be able to interpret data quickly in order to provide insights that would help your clients improve their business operations.

There are many different types of accounting jobs that you can do with Salesforce, so it’s important to find one that matches your skills and interests.

If you’re interested in working with numbers and providing financial analysis, then a position as a financial analyst could be a good fit. Alternatively, if you’re more interested in providing support to users and helping them troubleshoot issues, then a customer success manager role might be right for you. Whichever type of job you choose, you’ll need to have excellent communication skills as well as experience working with Salesforce in order to succeed.

Native Salesforce Accounting Software

In the business world, time is money. That’s why a lot of businesses are looking for accounting software that can save them time and help them keep track of their finances. Salesforce is one of the most popular CRM platforms, and it now offers its own accounting software called FinancialForce.

FinancialForce is designed to work seamlessly with Salesforce, so if you’re already using Salesforce for your CRM needs, this could be a good option for you. It includes features like invoicing, accounts receivable and payable, expense management, and reporting. And because it’s native to Salesforce, it integrates tightly with all of your other Salesforce data.

If you’re considering FinancialForce as your accounting solution, here are a few things to keep in mind:

1. Make sure it meets your specific needs. Every business is different, so you’ll want to make sure that FinancialForce has the features that you need.

For example, if you have complex invoicing requirements, make sure that FinancialForce can handle them.

2. Consider the learning curve. If you’re not familiar with using Salesforce or accounting software in general, there may be a bit of a learning curve when getting started with FinancialForce.

But once you get the hang of it, it should be pretty easy to use on a daily basis.

3 . Weigh the costs .

There’s no denying that financial software can be expensive . But when compared to other options on the market , FinancialForce is actually quite reasonably priced . Be sure to consider all of the costs associated with any software solution before making a final decision .

There may be additional costs for things like support or training , which can add up over time .

4 Get input from your team If you’re considering switching to FinancialForce , get input from everyone on your team who will be using it . They may have some valuable insights that you didn’t consider . And finally , don’t forget to try out the free trial version before making any decisions !

Salesforce Accountant Salary

Salesforce accountant salaries vary depending on experience and location. However, the average salary for a Salesforce accountant is $65,000 per year. Salaries for experienced Salesforce accountants can range from $85,000 to $115,000 per year.

The highest paying region for Salesforce accountants is the Bay Area in California, where salaries can reach up to $130,000 per year.

Conclusion

Salesforce is a cloud-based CRM software that can be used for accounting. It offers features such as invoicing, tracking sales and expenses, and managing customer data. Salesforce also integrates with other accounting software, making it a versatile tool for businesses of all sizes.