What is Enterprise Accounting Software?

Anúncios

Enterprise accounting software is a type of business accounting software that is designed for larger businesses with multiple users. It typically includes features such as multi-currency support, advanced reporting, and workflow management. Enterprise accounting software can be deployed on-premise or in the cloud.

Enterprise accounting software is a type of software that helps businesses manage their finances. This type of software can be used to track income and expenses, create financial reports, and manage inventory. Enterprise accounting software typically includes features such as budgeting, invoicing, and payroll.

Anúncios

Overview of Enterprise Accounting Software – The ERP Advisor Podcast Episode 48

What is Enterprise Financial Software?

Enterprise financial software is a type of computer program that is designed to help businesses manage their finances. This software can track income and expenses, create financial reports, and help businesses make decisions about where to allocate their resources. Enterprise financial software can be used by small businesses or large corporations.

There are many different types of enterprise financial software available on the market today. Some programs are designed for specific industries, while others are more general in nature. Many enterprise financial software programs offer a free trial period so that businesses can try out the program before committing to a purchase.

When choosing an enterprise financial software program, it is important to consider the needs of your business and the features that you require. Some programs may offer more features than you need, while others may not have all the features you want. It is also important to compare prices between different enterprise financial software programs before making a final decision.

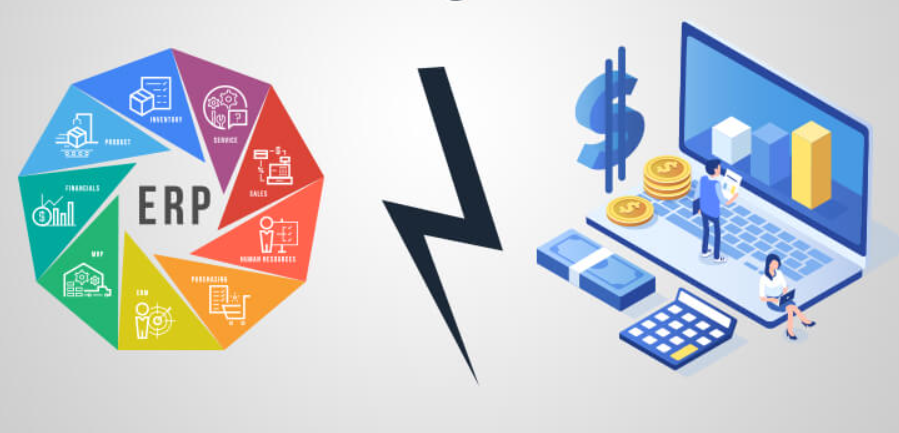

What is Erp Vs Accounting Software?

ERP vs accounting software is a topic that often comes up when businesses are looking for new software to streamline their operations. Both types of software offer different benefits, so it’s important to understand the difference between them before making a decision.

ERP stands for enterprise resource planning.

This type of software is designed to manage all aspects of a business, from inventory and manufacturing to customer relationship management and financials. An ERP system can be complex and expensive, but it offers a comprehensive solution for businesses that need to track and manage multiple processes.

Accounting software, on the other hand, is focused solely on financial transactions.

It can track income and expenses, generate reports, and help with tax preparation. Accounting software is typically less expensive than ERP systems, but it doesn’t provide the same level of functionality or integration.

So, which type of software is right for your business?

It depends on your needs. If you need an all-in-one solution that will track every aspect of your operation, an ERP system is probably the way to go. But if you’re just looking for something to handle your finances, accounting software will likely suffice.

Anúncios

What are the Three Types of Accounting Software?

When it comes to accounting software, there are three main types that businesses use: off-the-shelf, bespoke and cloud-based. Off-the-shelf accounting software is the most popular type used by small businesses. This type of software is usually easy to set up and use, and is often more affordable than other options.

Bespoke accounting software is designed specifically for a business, taking into account their specific needs and requirements. This type of software can be more expensive than off-the-shelf options, but can offer a better fit for businesses with complex needs. Cloud-based accounting software is a newer option that allows businesses to access their accounts and data online from any location.

This can be a convenient option for businesses with employees who work remotely or travel frequently.

What Does Accounting Software Mean?

When most people think of accounting software, they think of a program that helps them keep track of their finances. However, there is much more to accounting software than just that. Accounting software can also help businesses manage their inventory, create invoices and track payments, and generate financial reports.

In short, accounting software is a versatile tool that can be used to manage all aspects of a business’s finances.

There are many different types of accounting software available on the market today, so it’s important to choose one that meets the specific needs of your business. If you’re not sure where to start, you can always consult with an accountant or other financial advisor to get some recommendations.

Once you’ve chosen the right accounting software for your business, you’ll be able to streamline your financial operations and save yourself a lot of time and effort in the long run.

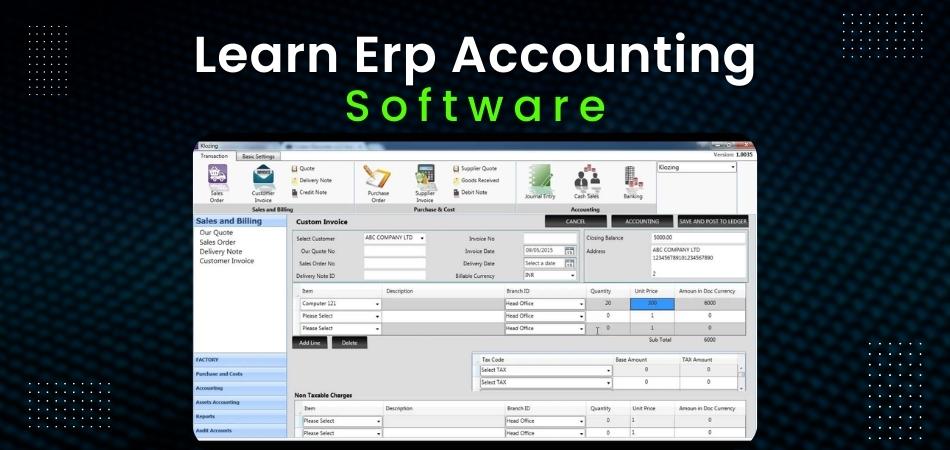

Credit: www.flexi.com

Examples of Enterprise Accounting Software

Enterprise accounting software helps businesses manage their finances, including budgeting, invoicing, and financial reporting. There are many different enterprise accounting software solutions available on the market, each with its own unique features and benefits. Here are some examples of enterprise accounting software that can help your business manage its finances:

1. Intacct: Intacct is a cloud-based enterprise accounting software solution that offers a variety of features to help businesses manage their finances. These features include invoicing, financial reporting, and budgeting. Intacct also offers a mobile app so you can access your account information on the go.

2. Oracle E-Business Suite: Oracle E-Business Suite is an on-premise enterprise accounting software solution that offers a comprehensive set of financial management tools. These tools include accounts payable, accounts receivable, general ledger, and cash management.Oracle E-Business Suite also offers a mobile app so you can access your account information on the go.

3. Sage 300cloud: Sage 300cloud is a cloud-based enterprise accounting software solution that offers a variety of features to help businesses manage their finances.

These features include financial reporting, invoicing, and budgeting. Sage 300cloud also has a mobile app so you can access your account information on the go.

What is Custom Accounting Software

When it comes to accounting, there is no one-size-fits-all solution. Businesses have different needs and requirements, which is why custom accounting software exists.

Custom accounting software is built specifically for a business, taking into account its specific needs and requirements.

This means that the software is tailored to the business, making it much more efficient and effective than off-the-shelf accounting software.

There are many benefits of using custom accounting software, including:

Increased Efficiency: Custom accounting software is designed to be as efficient as possible, meaning that businesses can save time and money.

Improved Accuracy: With bespoke features and functionality, businesses can be sure that their data is accurate and up-to-date. This helps to avoid any costly mistakes.

Greater Flexibility: Because custom accounting software is designed specifically for a business, it can be easily adapted and changed as the business grows or changes direction.

This flexibility is not possible with off-the-shelf solutions.

What is Legal Accounting Software

If you are in the business of law, then you know that legal accounting software is a must. This type of software helps you to keep track of your finances, clients, and cases. It can also help you to manage your time better and stay organized.

There are many different types of legal accounting software on the market, so it is important to find one that will work best for your needs. Here is some basic information about this type of software:

Most legal accounting software programs will allow you to track your income and expenses.

This is important in order to maintain accurate financial records. You will also be able to track billable hours and case expenses. This information can be helpful in determining how much money you are making per hour or per case.

Some legal accounting software programs also offer time tracking features. This can be very helpful if you need to keep track of deadlines or court appearances. Time tracking can also help you to see where most of your time is being spent so that you can make changes accordingly.

Most legal accounting software programs will offer some sort of customer relationship management (CRM) features. This means that you will be able to store client contact information and keep track of communication between yourself and the client. This can be very helpful when trying to build or maintain relationships with clients.

When choosing a legal accounting software program, it is important to find one that offers the features that are most important to you. Make sure that the program is compatible with other software programs that you use such as Microsoft Office or QuickBooks.

Conclusion

Enterprise accounting software is a tool that helps businesses manage their finances. It can be used to track income and expenses, create financial reports, and more. This type of software is typically designed for larger businesses, and it can be expensive.

However, it can offer many benefits, such as improved accuracy and efficiency in financial management.