7 Steps for Retirement Planning: Learn How to Do It

Anúncios

Retirement, often dubbed the golden years, is a phase of life that many of us eagerly await. It’s a time when you can finally bid farewell to the daily grind, embrace your passions, and enjoy the fruits of your lifelong labor.

However, to ensure that your retirement is as comfortable and fulfilling as you envision, proper planning is essential.

Anúncios

In this comprehensive guide, we’ll walk you through the seven crucial steps for retirement planning that will help you secure your financial future and make the most of your retirement years.

Anúncios

Why is Retirement Planning So Important?

Before delving into the nitty-gritty of retirement planning, it’s vital to understand why it’s of paramount importance.

Retirement planning is not merely a financial endeavor; it’s a strategic approach to secure your future and maintain your quality of life.

The rationale behind retirement planning is multi-faceted. Firstly, it is essential to break free from the cycle of work.

As much as we love our careers, there comes a time when we’d prefer leisure over labor. Without proper planning, you might find yourself working well into your golden years just to make ends meet.

The planning empowers you to retire on your terms and enjoy life as you desire.

Secondly, it’s a means to reduce dependency on Social Security. While Social Security can provide a safety net, it’s rarely sufficient to fund the retirement lifestyle most people envision.

Proper planning enables you to supplement your Social Security benefits and ensures you have enough income to cover your expenses.

Finally, retirement planning gives you peace of mind. Knowing that you have a solid financial cushion for retirement alleviates stress and anxiety.

It allows you to focus on the enjoyable aspects of your golden years, from travel and hobbies to spending quality time with loved ones.

Understanding How Much You Need to Save:

Before embarking on your retirement planning journey, it’s essential to gain a comprehensive understanding of how much money you’ll need to save for a comfortable and secure retirement.

This step lays the foundation for all your future financial decisions. To determine the right savings target, consider factors such as:

- your current annual income,

- expected annual expenses,

- and the lifestyle you aspire to have in retirement.

It’s not merely about replacing your pre-retirement income; you must factor in potential increases in healthcare costs, leisure activities, travel plans, and unexpected expenses that may arise.

One common guideline is to aim for replacing 70% to 90% of your pre-retirement income through a combination of savings and Social Security benefits.

For instance, if you currently earn an average of $63,000 per year before retirement, you should expect to need $44,000 to $57,000 per year in retirement.

These numbers can serve as a starting point for your retirement savings goal. However, it’s crucial to remember that everyone’s retirement needs are unique.

Your savings target may be higher or lower based on your individual circumstances and aspirations.

To gain a more accurate estimate, you can utilize various online retirement calculators that take into account your specific financial situation, including factors like inflation and investment returns.

By understanding how much you need to save, you can develop a tailored retirement plan that aligns with your financial goals and helps you work towards a financially secure and enjoyable retirement.

When Can I Retire?

The question of when you can retire is a pivotal one in your retirement planning journey. The answer is as individual as you are.

It hinges on your personal financial situation, your goals, and your willingness to adapt your retirement age to your financial readiness.

For many, the earliest possible age for retirement is linked to Social Security benefits. You can start claiming Social Security benefits as early as age 62.

However, it’s crucial to be aware that if you claim early, you’ll receive a reduced portion of your full benefits. For those born in 1960 or later, the full retirement age is 67.

Delaying your Social Security benefits beyond this age can result in increased monthly benefits, making it a prudent choice for those looking to maximize their income in retirement.

Ultimately, the timing of your retirement depends on your financial preparedness. The goal is to ensure that when you do retire, you have enough savings to replace your working income and fund your desired lifestyle.

This may mean retiring earlier if you’ve diligently saved or, conversely, extending your career if you still need to catch up on your savings.

Remember, retirement is not just a destination; it’s a journey that you can tailor to your unique circumstances and aspirations.

7 Steps for Retirement Planning

Now that we’ve established the significance of retirement planning and addressed the question of when you can retire, let’s dive into the seven essential steps for creating a robust retirement plan.

1. Establish a Goal

The first step in your retirement planning journey is to set a clear and realistic goal. Your goal should encompass not only a specific dollar amount but also your desired retirement lifestyle.

Consider factors such as your current age, anticipated retirement age, expected expenses, and any additional sources of retirement income.

Creating a concrete goal will serve as your financial roadmap and help you stay on track throughout your retirement journey.

2. Determine Your Spending Needs

To determine how much money you’ll need in retirement, it’s vital to understand your spending needs.

Consider your current income and expenses, and assess how these might change during retirement.

Factors like healthcare costs, travel plans, and leisure activities all play a role in shaping your retirement budget.

The general guideline is to aim for replacing 70% to 90% of your pre-retirement income through a combination of savings and Social Security benefits.

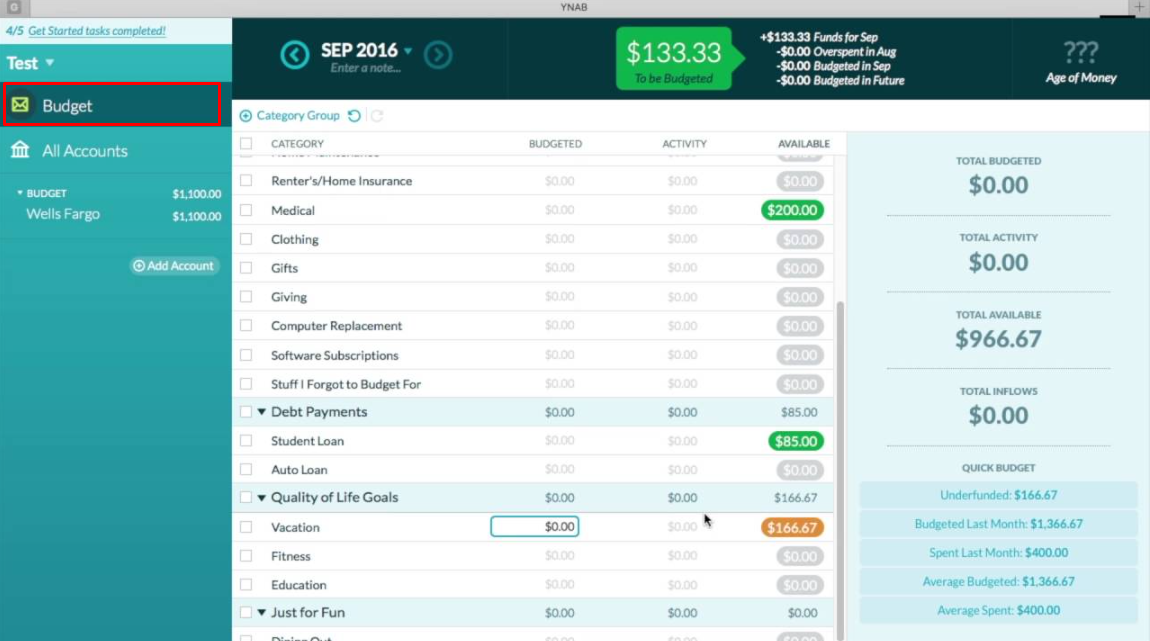

3. Choose the Best Retirement Plan

With your goal and financial needs in mind, it’s time to select the most suitable retirement plan for your situation.

If your employer offers a 401(k) or similar retirement plan with matching contributions, consider starting there.

These plans often provide valuable tax advantages and an extra incentive to save.

If you don’t have access to an employer-sponsored plan or want to diversify your retirement savings, an Individual Retirement Account (IRA) can be an excellent choice.

There are different types of IRAs, including Roth and Traditional, each with its own set of advantages.

4. Select Your Investments

Your retirement accounts are like containers for your money, and now it’s time to decide what investments to put inside.

The optimal investment mix depends on your time horizon and risk tolerance. In general, it’s recommended to start with a more aggressive approach when you’re young and gradually shift towards a conservative strategy as you approach retirement age.

Diversification across various asset classes can help manage risk and enhance the potential for long-term growth.

5. Save as Much as You Can

Saving consistently is one of the cornerstones of a successful retirement plan. The earlier you begin saving, the more time your money has to grow through the magic of compound interest.

Even if you start late, every dollar you save brings you closer to your retirement goals.

Consider increasing your contributions over time, especially if your employer offers a matching program or if you’re eligible for catch-up contributions once you reach age 50.

6. Adjust Your Retirement Plan

Life is filled with unexpected twists and turns, which can impact your financial goals. I

f you encounter times when you couldn’t save as much as you’d hoped, you have several options to make up for it.

Increasing your contributions, paying off debt, or extending your retirement date are all strategies that can help you stay on track.

7. Check Your Plan at Least Once a Year

Just as you review your monthly budget, it’s essential to revisit your retirement plan regularly.

Circumstances change, and your financial goals may evolve.

By checking your plan annually, you can make necessary adjustments, ensure that your investments align with your objectives, and stay on course to achieve your retirement aspirations.

Conclusion

Retirement planning is a dynamic process that involves setting clear objectives, understanding your financial needs, and making informed decisions about your retirement accounts and investments.

By following these seven essential steps, you can create a retirement plan that not only secures your financial future but also enables you to enjoy the retirement you’ve always dreamed of.

Remember, the earlier you start planning, the more control you have over shaping your retirement journey, so don’t wait to embark on this exciting financial adventure.