Business bank account: Learn what is necessary to open yours

Anúncios

Opening a business bank account is a very important step for any entrepreneur who cares about their financial well-being.

It separates your personal finances from your business finances, which simplifies accounting, enhances professionalism, and can pave the way for new economic opportunities.

Anúncios

Whether you’re just starting with a small business or running a large company, understanding the process and benefits of opening a business bank account helps ensure your venture’s success.

Do you want to open a business bank account? Staying informed on the subject is crucial. Read on to understand what is necessary to open yours.

Anúncios

Why open a business bank account?

Opening a business bank account is important for the success and financial organization of any business.

This step allows the entrepreneur to keep the company’s finances separate from personal ones, simplifying the control of income and expenses.

A business bank account can help improve the company’s professional image and facilitate access to financial services specifically for businesses, such as loans and lines of credit.

Organized business finances

Keeping your personal and business finances separate is essential for maintaining clear financial records. A business bank account allows you to easily track your business’s income, expenses, and cash flow.

By simplifying tax preparation, you ensure that your financial documentation is well-organized when needed.

This separation also makes it easier to monitor profitability and manage operational expenses without mixing personal and business spending.

Enhances your business professionally

Opening a business bank account elevates your company’s professional image. Clients and partners expect to transact with a legitimate business, not through personal bank accounts.

A business account allows you to make payments, receive deposits, and manage work-related transactions in the company’s name.

This adds credibility to your brand and helps build trust with customers, suppliers, and investors.

Easier access to business credit and loans

Banks usually offer a range of financial services specifically for businesses, such as credit cards, loans, and lines of credit.

Establishing a relationship with a bank through a business account contributes to building your company’s credit history.

This is important if you plan to seek financing, as financial institutions review the history before determining eligibility for loans.

Convenience in managing business expenses

Managing your business expenses is much simpler when you have an account dedicated exclusively to the company.

You will have access to detailed statements that clearly show business-related purchases and payments, helping analyze spending patterns and allocate funds appropriately.

Most banks offer tools like budgeting apps and expense management software that integrate with business accounts, making financial management even more efficient.

Security with legal protection

A business bank account offers an additional layer of legal protection for business owners, especially those operating as LLCs or corporations.

By keeping your accounts separate, you reinforce the legal distinction between you and your business, helping to protect your personal assets in case of legal disputes or financial issues within the company.

How to open a business bank account

Opening a business bank account might seem like a complex process, but with the right information, it can be a simple step that helps organize and grow any company.

Having an account dedicated to the business not only facilitates financial management but also provides greater credibility and legal protection for the business.

To ensure everything runs smoothly, it’s important to understand the requirements and steps involved in opening a business bank account.

Below, check out the necessary steps to complete this process correctly and efficiently.

Understand your business needs

Before opening a business bank account, it’s very important to consider your company’s unique financial needs.

Some businesses require an account with minimal fees, while others prioritize robust transaction features or access to lines of credit.

Start by assessing your cash flow, the number of monthly transactions, and any additional services your company may need, such as payroll support or merchant services.

Compare business account options

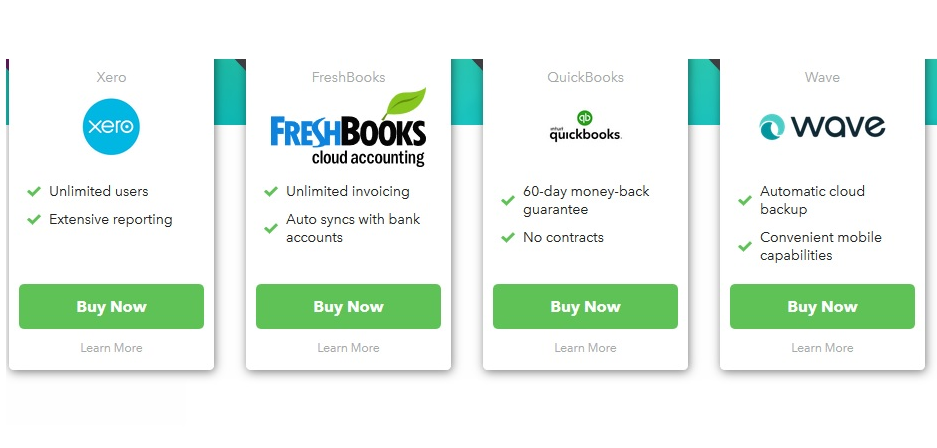

Not all business bank accounts are the same. Different financial institutions offer varying fee structures, features, and customer service options.

Some accounts may require a minimum balance, while others offer perks like free transfers or cashback on business expenses.

It’s important to compare several banks and their offerings, paying attention to fees, transaction limits, and any additional services that could benefit your company.

Consider institutions that have strong business banking divisions, especially those that offer flexibility and scalability for growing businesses.

If your company operates internationally, you may want to look for a bank that offers support for global transactions or multi-currency accounts.

On the other hand, if your business is local, a regional bank or credit union might be more convenient, offering personalized service and lower fees.

Gather your personal documents

To open a business bank account, you will need to provide personal identification documents, just as you would when opening a personal account.

Banks require government-issued identification, such as a driver’s license or passport, along with your social security number.

If you have partners, they may also need to provide their IDs, especially if they are authorized signers on the account.

Prepare your business documentation

Banks will also require specific business documentation. The requirements vary depending on your company’s legal structure, but generally, you will need to provide the following documents:

- Employer Identification Number (EIN): This is like a social security number for your business and is issued by the IRS. Sole proprietors may use their personal social security numbers instead.

- Business formation documents: These include your LLC operating agreement, articles of incorporation, or partnership agreements, depending on your company type.

- Business license: Some banks may require proof that your business is legally authorized to operate in your state.

- Ownership agreements: If the company has multiple owners, the bank will likely ask for documentation detailing ownership percentages and decision-making authority.

Request the account opening

Once you have gathered all the necessary documents and chosen the best bank for your needs, it’s time to open your business bank account.

The process involves completing an application, either online or in person, depending on the bank’s policies.

Some institutions allow you to submit everything online, while others may require an in-person visit to verify your identity and documents.

After submitting your application, the bank will review your information. If everything is in order, they will approve the account, and you will be ready to start managing your company’s finances through this new business bank account.

Depending on the institution, the entire process can take a few days or a few weeks.

Are you ready to manage a business bank account? Take advantage of the tips from this article to optimize both your personal and business financial life.

We hope you enjoyed the information gathered especially for you! Continue following other posts on the website for more insights.

Looking for a suggestion? Check out this guide explaining whether paying bills online is a good idea!