How to close a bank account? Understand the process and follow tips

Anúncios

Closing a bank account is not as simple as canceling any product, but by doing it correctly, you can ensure that the account is closed more quickly.

To close an account, you need to call your bank, go to a branch, or do it online, depending on the bank’s preferences.

Anúncios

Obviously, as we mentioned earlier, it’s not as simple as closing an account, so be aware that some additional steps must be followed.

Closing an account correctly is essential to protect your financial security and stability.

Anúncios

If you want to know how to close your bank account without errors, keep reading, and we will show you more details!

When should I close a bank account?

Closing a bank account is an important decision that can significantly affect your personal financial management.

Various factors should be considered when evaluating if this is the right time to close an account.

Among them are the quality of the service offered by the bank, the fees charged, the account’s accessibility, and also its inactivity.

Understanding these main aspects can help you make an informed decision and ensure that you are receiving the best possible service from your bank.

Quality of service

The quality of service provided by your bank is a crucial factor to consider when deciding whether to close your account.

If your bank consistently fails to meet your expectations with poor customer service, slow response times, or unresolved issues, it may be time to move on.

Offering excellent customer service is essential for a positive banking experience.

If you are frequently frustrated with your bank’s service, it is a strong indication that you should consider closing your account and opening one with another bank that values and prioritizes customer satisfaction.

The fees charged

Bank fees can quickly add up and eat into your savings. If you find that your bank charges exorbitant fees for account maintenance, ATM use, overdrafts, and other services, you might want to consider switching to a bank with more reasonable fees.

Some banks offer fee-free or low-fee accounts, which can significantly reduce your monthly expenses.

It is crucial to regularly review your bank’s fee structure and compare it with other banks to ensure you are getting the best deal.

Unnecessarily high fees are a valid reason to close your current account and open one with a more cost-effective institution.

Account accessibility

Accessibility is another vital aspect of a bank account. If your current bank does not have enough branches or ATMs in your area, it can make banking activities inconvenient.

Additionally, if online and mobile banking platforms are outdated or difficult to use, it hinders effective financial management.

A bank that offers robust online and mobile banking services, along with a wide network of branches and ATMs, can greatly enhance your banking experience.

If your bank does not meet these criteria, closing your account and finding a more accessible option can be beneficial.

Account inactivity

If you have an account that you no longer use, it might be worthwhile to close it. Keeping inactive accounts increases the likelihood of incurring unnecessary fees and the risk of fraud.

Additionally, managing multiple accounts can complicate your financial life. By closing inactive accounts, you can simplify your finances and reduce the risk of unexpected charges or fraudulent activities.

It is important to regularly review your accounts and close those you no longer need to maintain a more organized and secure financial history.

How to close a bank account?

Closing a bank account can seem like a complicated task, but with proper preparation and following the correct steps, the process can be quite smooth and efficient.

This procedure involves more than just informing the bank that you wish to close the account.

You need to consider aspects such as choosing a new account, updating payment information, and transferring funds.

Choose a new account

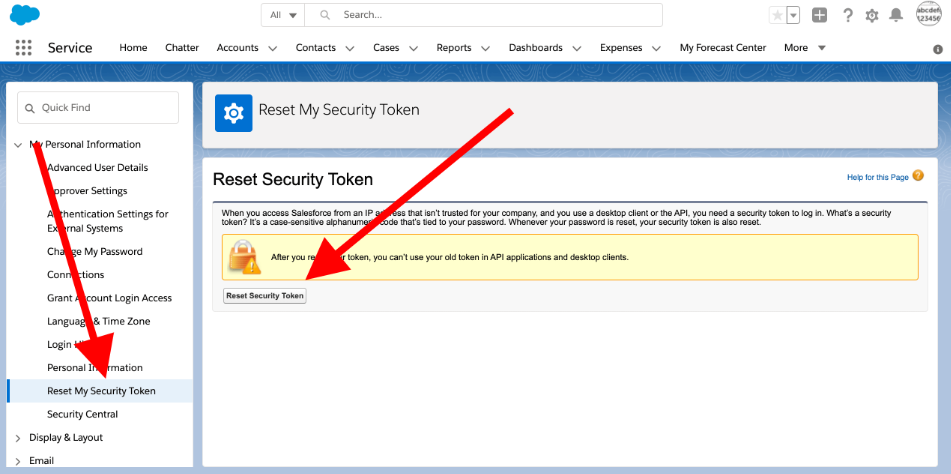

Before closing your current bank account, it is essential to choose a new one that meets your real needs.

Research different banks and their offerings, focusing on factors such as customer service, fees, accessibility, and account features.

Look for a bank that aligns with your financial goals and offers the convenience and services you need, both now and in the long term.

Once you have selected a new bank, open an account and ensure it is fully operational before proceeding with closing the old account.

This step ensures a smooth transition and continuity in your financial activities, posing no risks to your bank accounts.

Cancel payments and deposits

To avoid any disruption, you must cancel all automatic payments and direct deposits linked to your old account.

Update your payment information with the new bank details for services such as utilities, subscriptions, and loans.

Notify your employer and other sources of direct deposits about your new banking information to avoid potential issues.

It is important to give yourself enough time to ensure all changes are processed correctly and to avoid any missed payments or problems with your deposits.

Properly managing this account transition can help you avoid late fees and other complications.

Transfer the money

After updating your payment and deposit information, transfer the remaining balance from your old account to the new one.

Ensure all pending transactions have been settled to avoid issues. It is a good idea to leave a small reserve amount in the old account for a few weeks to cover any unexpected transactions.

Once you are confident that all transactions have been completed and your new account is functioning smoothly, you can proceed with closing the old account.

Transferring your funds correctly is crucial to ensure no money is lost in the transition.

Contact the old bank and close the account

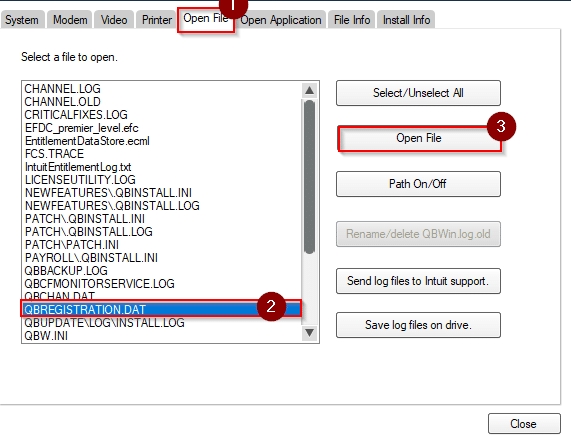

The final step to close your bank account is to contact your old bank to complete the operation.

You can do this by visiting a branch, calling customer service, or sending a written request to the bank.

Some banks may require you to fill out a form or send a written confirmation of your request.

Make sure to follow the specific bank’s procedures to ensure your account is closed correctly.

Once the account is closed, request a written confirmation for your records. This step is important to avoid any future disputes or issues with the closed account.

How much does It cost to close an account?

Generally, there is no cost to close checking, savings, or even money market accounts.

However, time deposit accounts, such as certificates of deposit (CDs), may incur a penalty fee.

Most of these time deposit banks charge a penalty for early withdrawal if the account is closed before maturity.

Closing a bank account is an important decision that should be made with care. By considering factors such as service quality, fees, accessibility, and account inactivity, you can determine if it is time to switch banks.

Following the proper steps to choose a new account, cancel payments and deposits, transfer your money, and contact your old bank will ensure a smooth transition.

Always prioritize finding a bank that meets your needs and offers a positive banking experience.

Keep following our content for more tips and information on how to effectively manage your personal finances.