What Accounting Software Does Deloitte Use?

Anúncios

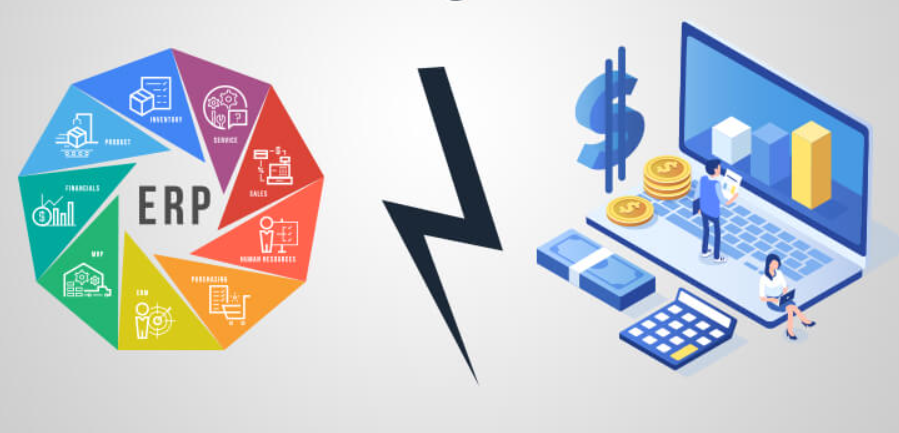

Deloitte is one of the world’s largest accounting firms, and they have a very sophisticated accounting software system. The software that Deloitte uses is called “SAP Business One” and it is a enterprise resource planning (ERP) system. This software helps Deloitte to manage their financial data, inventory, customer relationship management, and other business processes.

Deloitte is one of the “Big Four” accounting firms, so you would expect them to use the best and most popular accounting software available. And they do – Deloitte uses SAP Accounting Software.

SAP is a German company that offers enterprise software to businesses of all sizes.

Their accounting software is used by many large businesses and organizations around the world. Deloitte chose to use SAP because of its flexibility, scalability, and features.

Some of the features that Deloitte likes about SAP include: the ability to consolidate financial statements from multiple entities, real-time visibility into financial data, and robust financial reporting capabilities.

Using SAP also allows Deloitte to integrate their accounting systems with other business processes, such as human resources and supply chain management.

Overall, using SAP gives Deloitte a competitive advantage in the marketplace. It helps them provide better service to their clients and operate more efficiently as a business.

Anúncios

the truth about big four accounting NO ONE TELLS (salary, "balance", dating etc)

What Software Do Most Accountants Use?

The vast majority of accountants use accounting software to perform their work. The most popular accounting software programs are QuickBooks, Peachtree and Microsoft Dynamics GP. These programs offer a variety of features that allow accountants to perform many different tasks, including bookkeeping, financial analysis and reporting.

What Audit System Does Deloitte Use?

Deloitte’s audit system is based on a risk-based approach. This means that the auditor will assess the risks associated with the client and their business, and then design the audit plan accordingly. The goal of this approach is to ensure that all material risks are identified and addressed in the audit.

In order to do this, Deloitte uses a number of different tools and techniques. For example, they may use analytical procedures to identify trends or relationships that could indicate a risk. They may also interview management and employees to get a better understanding of the client’s business and how it operates.

Ultimately, the goal of Deloitte’s audit system is to provide clients with assurance that their financial statements are free from material misstatement. This gives investors and other stakeholders confidence in the accuracy of these statements, which is crucial for making informed decisions about investing in or working with a company.

Anúncios

What Software Does Deloitte Use for Tax?

Deloitte is one of the ‘Big Four’ accounting firms, and as such, is one of the largest professional services networks in the world. The company provides audit, consulting, financial advisory, risk management, tax and legal services to a range of clients, including public and private companies, governments, not-for-profit organisations and individuals.

In terms of tax software, Deloitte uses a number of different platforms depending on the needs of its clients.

These include ProSystem fx Tax for corporate tax compliance; Lacerte for individual tax returns; and TaxStream for sales & use tax compliance. The firm also has its own proprietary software platform called DbriefsTax that helps clients manage their global tax affairs.

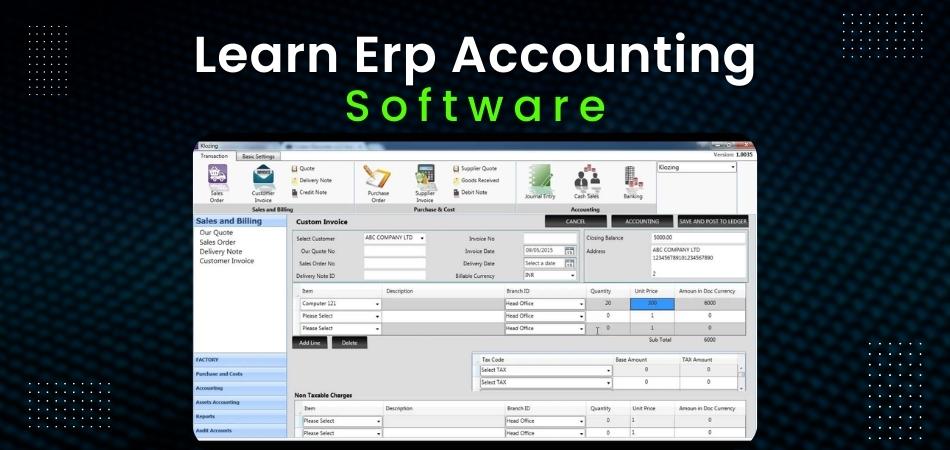

What Software Do Accounting Firms Use?

Accounting firms use a variety of software to perform their tasks. The most popular accounting software used by accounting firms is QuickBooks, which is a desktop application that can be installed on a computer or server. Other popular accounting software used by firms include Microsoft Dynamics GP, Sage 50 and Xero.

Credit: www2.deloitte.com

What Tax Software Does Deloitte Use

Deloitte is one of the world’s largest accounting and professional services firms, providing a wide range of services to clients around the globe. The firm is well known for its work in auditing, tax, consulting, and financial advisory. So what kind of software does such a large and well-known firm use to help manage its taxes?

Deloitte uses a variety of different software programs to help manage its taxes. For example, the firm uses Thomson Reuters’ Tax & Accounting Software Suite to help with tax compliance and planning. This suite includes a number of different applications that can be used to help prepare and file taxes, as well as track tax payments and refunds.

In addition to the Thomson Reuters suite, Deloitte also uses Intuit’s Lacerte Tax Software. Lacerte is another popular program that helps with tax preparation, filing, and tracking. It offers similar features to the Thomson Reuters suite but also includes some unique tools that can be helpful for Deloitte’s tax professionals.

Finally, Deloitte also makes use of Microsoft Excel for some tax-related tasks. While not technically a “tax software” program per se, Excel is nevertheless an essential tool for many accountants and tax professionals. Deloitte utilizes Excel for tasks such as preparing complex calculations or creating customized reports.

Overall, Deloitte employs a variety of different software programs to help it manage its taxes effectively.

Audit Software Used by Kpmg

As one of the Big Four accounting firms, KPMG is a trusted name in the auditing world. And their audit software is just as reliable. Here’s a look at some of the features and benefits of KPMG’s audit software:

-A comprehensive suite of tools: KPMG’s audit software includes everything you need to conduct a thorough and accurate audit. From data analysis to report generation, you can be confident that all your bases will be covered.

-Flexible and customizable: The software is designed to be flexible, so you can tailor it to meet your specific needs.

And if you need any help getting started, the team at KPMG is always happy to lend a hand.

-User-friendly interface: You don’t have to be a tech expert to use this software – the interface is straightforward and easy to navigate. That means anyone on your team can get up and running quickly and start contributing right away.

What Accounting Software Does Ey Use

If you’re an accountant, chances are you’re always on the lookout for new accounting software to make your job easier. But what accounting software does Ey use?

Ey is a global accounting firm with over 40,000 employees in 150 countries.

So it’s no surprise that they use a variety of different accounting software programs to cater to their diverse clientele. Some of the most popular accounting software programs used by Ey include:

1. QuickBooks: QuickBooks is one of the most popular accounting software programs used by small businesses.

It’s easy to use and can help you manage your finances quickly and efficiently.

2. SAP: SAP is a enterprise resource planning (ERP) system that helps businesses manage their finances, inventory, and other business processes. It’s widely used in large businesses and organizations, and Ey is no exception.

3. Microsoft Dynamics GP: Microsoft Dynamics GP is another ERP system that’s similar to SAP in terms of functionality. However, it’s more affordable and thus more popular among small and medium-sized businesses.

4. Xero: Xero is a cloud-based accounting program that gives users real-time visibility into their financial data.

It’s ideal for businesses who want to ditch traditional paper-based methods in favor of a more modern approach.

Conclusion

Deloitte is one of the world’s largest accounting firms, so it’s no surprise that they use a robust accounting software to manage their finances. The software they use is called SAP Concur, and it helps them automate many of their financial processes, including invoicing, expense management, and travel booking. This allows Deloitte to focus on their core business activities and provides their clients with a more efficient way to manage their finances.